Part 2

What the State owns

6 Overview of state ownership

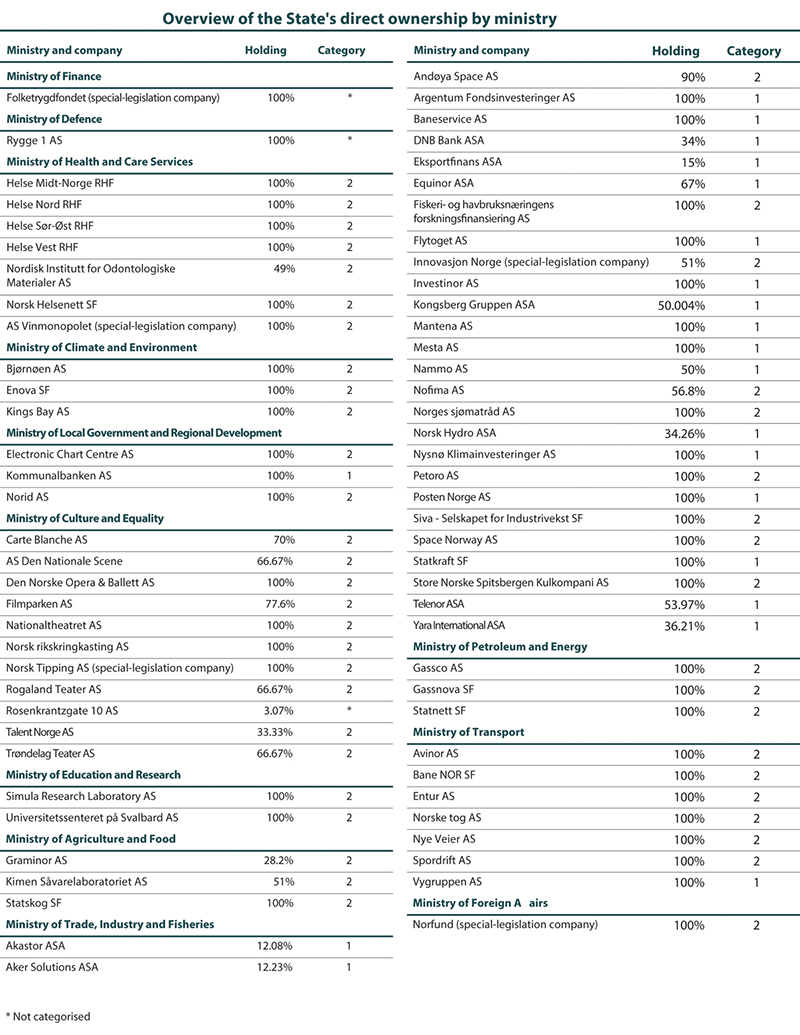

The State’s direct ownership comprises companies where the State’s ownership is managed directly by a ministry. This currently includes 70 companies, divided among twelve ministries, see Figure 6.3. Figure 6.3 also shows which category each of the companies belongs to, cf. Chapter 5.3. Chapter 7 provides a brief overview of the companies, including a statement of why the State is an owner and the State’s goal as an owner in each of the companies.

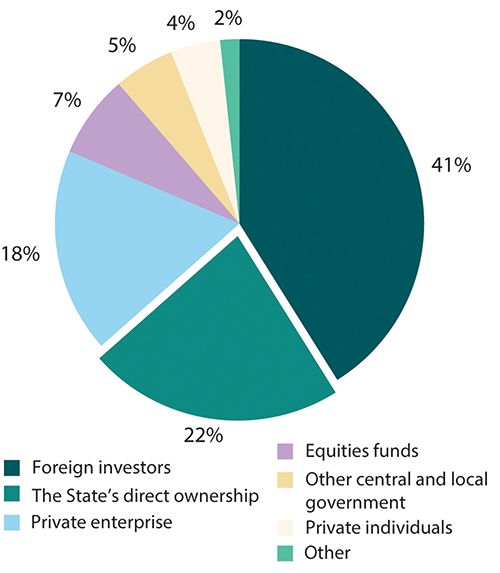

Figure 6.1 Ownership structure on Oslo Stock Exchange at the end of 2021. Percentage of market value.

Euronext Securities Oslo and the Ministry of Trade, Industry and Fisheries.

The State’s direct ownership is substantial when concerning both the number of companies and their value, and, when viewed in relative terms, it is more extensive than many other Western countries.

At year-end 2021, the value of the State’s ownership interests in companies for which the State’s goal as an owner is the highest possible return over time in a sustainable manner (Category 1), was estimated to be NOK 999 billion. The State’s shares listed on the Oslo Stock Exchange accounted for NOK 844 billion of the total value. The market value of the State’s shares in the company is used for the listed companies. The State’s share of book equity less minority interests is used for the unlisted companies, which may deviate significantly from the actual market value.

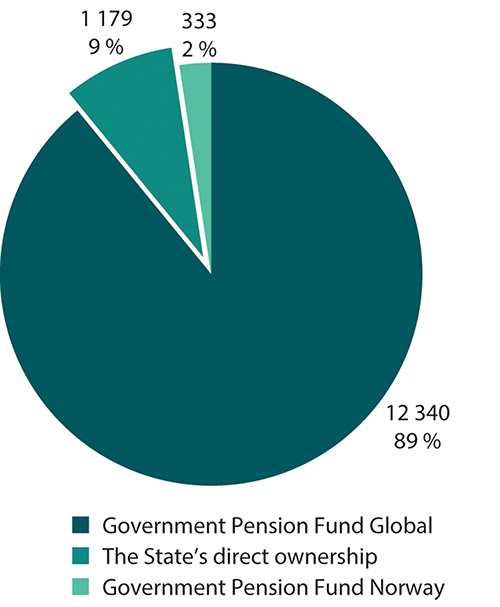

Figure 6.2 The Government Pension Fund and the State’s direct ownership at the end of 2021. NOK billion.

Norges Bank, the Ministry of Trade, Industry and Fisheries and Folketrygdfondet.

The State directly owns more than one-fifth of the total value on the Oslo Stock Exchange. As of the present date, the State is a direct shareholder in eight listed companies.

Valuations may be less relevant for companies in which the State’s goal as an owner is sustainable and the most efficient possible attainment of public policy goals (Category 2). The State’s share of book equity less minority interests in these companies was NOK 180 billion at the end of 2021. In 2021, these companies administered approximately NOK 207 billion in grants from the State and had turnover of NOK 310 billion.

The State’s direct ownership comes in addition to substantial financial wealth through the Government Pension Fund, which consists of the Government Pension Fund Global (GPFG) and the Government Pension Fund Norway (GPFN). The Government Pension Fund Global is invested globally outside of Norway and is managed by Norges Bank. The Government Pension Fund Norway is invested in all of the Nordic countries except for Iceland (although primarily in Norway), and is managed by Folketrygdfondet. The Government Pension Fund differs from the State’s direct ownership in several ways. One difference is that, through direct ownership, the State has substantial ownership interests in a small number of companies, while the goal of the investments in the Government Pension Fund is to have a broad spread across different types of financial assets.

Figure 6.3 Overview of the State’s direct ownership by ministry.

State ownership in other countries

Other countries also have direct state ownership. It is most natural to compare Norway with the other Nordic countries, which also have relatively substantial state ownership.

The Swedish state is a shareholder in 45 wholly and partly owned companies, two of which are listed. The total value of the Swedish state’s portfolio is approximately NOK 799 billion.1 The Finnish state is a shareholder in 68 wholly and partly owned companies, four of which are listed. In addition, the Finnish state has ownership interests in 12 listed companies through the holding company Solidium. The total value of the Finnish state’s portfolio is approximately NOK 469 billion.2 The Danish state owns shares in 30 wholly and partly owned companies, three of which are listed on the stock exchange.

7 Review of the companies with state ownership

The companies with state ownership have been divided into two categories depending on the State’s goal as owner. Category 1 comprises the companies with the goal of achieving the highest possible return over time in a sustainable manner, and Category 2 includes the companies with the goal of sustainable and the most efficient possible attainment of public policy goals. The companies are presented alphabetically in the two different categories in Chapters 7.1 (Category 1) and 7.2 (Category 2). The companies that are not categorised are presented in Chapter 7.3.

For each company, a description is provided of its activities, the State’s ownership and, where applicable, special framework conditions for the company. Further information about the companies is provided each year in the State Ownership Report.3

7.1 The companies in Category 1

Akastor ASA

About the company

Akastor invests in companies within the oil supplier industry. The company has a flexible investment mandate for active ownership and long-term value creation. At year-end 2021, Akastor’s investment portfolio had total capital employed of NOK 5.1 billion. The company’s largest investment is a 50 per cent stake in HMH, which is a joint venture between MHWirth (formerly owned by Akastor) and Baker Hughes SDS. Akastor is listed on the Oslo Stock Exchange and has its head office in Bærum.

At year-end 2021, the company had 431 employees and a market value of NOK 1.5 billion. Operating revenues in 2021 were NOK 953 million.

State ownership

The State has no special rationale for its ownership in Akastor. The State owns 12.08 per cent of the shares in Akastor.

The State’s goal as owner is the highest possible return over time in a sustainable manner.

In the budget proposal for 2023, the Government has proposed retaining the authority to partly or fully reduce the State’s ownership in Akastor.

Aker Solutions ASA

About the company

Aker Solutions delivers integrated solutions, products and services to the global energy industry. The company’s innovative solutions enable low-carbon oil and gas production and the development of renewable solutions to meet future energy needs. Aker Solutions is listed on the Oslo Stock Exchange and has its head office in Bærum.

At year-end 2021, the company had 15,012 employees and a market value of NOK 11.5 billion. Operating revenues in 2021 were NOK 29.5 billion.

State ownership

The State has no special rationale for its ownership in Aker Solutions. The State owns 12.23 per cent of the shares in Aker Solutions.

The State’s goal as owner is the highest possible return over time in a sustainable manner.

In the budget proposal for 2023, the Government has proposed retaining the authority to partly or fully reduce the State’s ownership in Aker Solutions.

Argentum Fondsinvesteringer AS

About the company

Argentum Fondsinvesteringer (Argentum) is an asset manager that primarily invests in private equity funds in Norway and Northern Europe. These funds invest in non-listed companies where they see potential for increased value creation and can contribute knowledge, capital and networks. Argentum also manages capital for private investors. The company was established in 2001. Argentum’s head office is situated in Bergen.

At year-end 2021, the company had 27 employees and book equity of NOK 13.3 billion. Operating revenues in 2021 were NOK 4.6 billion.

State ownership

The State’s rationale for ownership in Argentum is to maintain an investment company, aimed at active owner funds, with head office functions in Norway. The State owns 100 per cent of the shares in Argentum.

The State’s goal as owner is the highest possible return over time in a sustainable manner.

Baneservice AS

About the company

Baneservice provides railway-related maintenance services and new installations. The company was divested from what was then known as the Norwegian National Railway Administration in 2005. Baneservice’s head office is in Oslo.

At year-end 2021, the company had 606 employees and book equity of NOK 421 million. Operating revenues in 2021 were NOK 1.6 billion.

State ownership

The State’s rationale for ownership in Baneservice is to have a provider of railway-related operation and maintenance services and the development of installations for railway-related activities. The State owns 100 per cent of the shares in Baneservice.

The State’s goal as owner is the highest possible return over time in a sustainable manner.

DNB Bank ASA

About the company

DNB Bank (DNB) is Norway’s largest financial services group and one of the largest in the Nordic region. The Group offers a broad range of financial services, including loans, saving, investments, payment services, advisory services, real estate brokering, insurance and pension for private and corporate customers. The State acquired the DNB shares during the banking crisis of the 1990s. DNB is listed on Oslo Stock Exchange and is headquartered in Oslo.

At year-end 2021, the company had 9,659 employees and a market value of NOK 313.2 billion. Net interest income in 2021 was NOK 38.7 billion.

State ownership

The State has an ownership interest in DNB to maintain a leading financial services company with head office functions in Norway. The State owns 34 per cent of the shares in DNB.

The State’s goal as owner is the highest possible return over time in a sustainable manner.

Eksportfinans ASA

About the company

Eksportfinans manages a portfolio of loans to the Norwegian export industry, foreign buyers of Norwegian capital goods, and the municipal sector in Norway. A large proportion of the loans are guaranteed by Eksportfinansiering Norge (Eksfin) or banks. The company also manages a portfolio of international securities. Eksportfinans has not granted new loans since 2012, which was when Eksportkreditt Norge AS (now Eksfin) took over responsibility for providing new State-supported export credits. The company was established in 1962 and is now owned by 22 commercial and savings banks in addition to the State, which acquired its ownership interest through a private placement in 2001. Eksportfinans’ head office is in Oslo.

At year-end 2021, the company had 20 employees and book equity of NOK 6 billion. Operating revenues in 2021 were NOK 118 million.

State ownership

The State has no special rationale for its ownership in Eksportfinans. The State owns 15 per cent of the shares in Eksportfinans. In addition to the State, the largest owners in Eksportfinans are DNB Bank ASA with 40 per cent, Nordea Bank AB Norway Branch with 23 per cent, Danske Bank AS with 8 per cent and Sparebanken Øst with 5 per cent.

The State’s goal as owner is the highest possible return over time in a sustainable manner.

Equinor ASA

About the company

Equinor is an international technology and energy company whose main activity is the production of oil and gas. The company also has downstream operations and activities in renewable energy, such as offshore wind farms and solar energy. The company is a major seller of crude oil, condensate and natural gas on a global scale. Equinor markets and sells the State’s oil and gas together with its own volumes, cf. the Owner’s Instruction that was stipulated in the articles of association prior to the company’s listing in 2001. The company was established as a company wholly-owned by the State in 1972. Equinor is listed on Oslo Stock Exchange and the New York Stock Exchange and is headquartered in Stavanger.

At year-end 2021, the company had 21,126 employees and a market value of NOK 768.5 billion. Operating revenues in 2021 were NOK 782 billion.

State ownership

The State’s rationale for ownership in Equinor is to maintain a leading energy company with head office functions in Norway. The State owns 67 per cent of the shares in Equinor.

The State’s goal as owner is the highest possible return over time in a sustainable manner.

Special framework conditions for the company

The Marketing Arrangement (Avsetningsordningen) is a special framework condition for the State’s ownership in Equinor. The arrangement entails that Equinor markets and sells oil and gas from the State’s Direct Financial Interest (SDFI) together with its own volumes. The objective of the Marketing Arrangement is to obtain the highest possible total value from the SDFI volumes and Equinor’s volumes, and to ensure an equitable distribution of the total value creation. The Marketing Arrangement has been implemented through a separate instruction (Owner’s Instruction) adopted in the articles of association at Equinor’s general meeting on 25 May 2001 prior to the listing of the company. It is necessary for the implementation of the Marketing Arrangement that the State is the majority owner in Equinor.

Flytoget AS

About the company

Flytoget operates a rail passenger transport service between Drammen and Oslo Airport. The company was established in 1992 to develop the Gardermoen Line and the company has operated a passenger transport service on this line since Oslo Airport opened in 1998. Flytoget’s head office is in Oslo.

At year-end 2021, the company had 324 employees and book equity of NOK 814 million. Operating revenues in 2021 were NOK 567 billion.

State ownership

The State’s rationale for ownership in Flytoget is to have a provider of passenger rail services and to maintain the rail service to and from Oslo Airport. The State owns 100 per cent of the shares in Flytoget.

The State’s goal as owner is the highest possible return over time in a sustainable manner.

For passenger rail transport covered by the negotiations with the Norwegian Railway Directorate for the direct allocation of transport agreements for Eastern Norway, the State’s goal as owner is sustainable and the most efficient possible attainment of public policy goals.

Investinor AS

About the company

Investinor’s objective is to promote better access to capital in the early-phase market through the following business activities: 1) Active direct investments, 2) Follow-up of seed funds, 3) Follow-up of pre-seed funds, 4) Co-investment Fund for Northern Norway, 5) Fund and investment matchings, and 6) Follow-up of funds managed from Northern Norway. The company was established in 2008. Investinor’s head office is in Trondheim.

At year-end 2021, the company had 32 employees and book equity of NOK 5.6 billion. Operating revenues in 2021 were NOK 173 million.

State ownership

The State’s rationale for ownership in Investinor is to contribute to capital access for companies in an early phase of development. The State owns 100 per cent of the shares in Investinor.

The State’s goal as owner is the highest possible return over time in a sustainable manner.

Special framework conditions for the company

The company’s articles of association specify special guidelines for the company’s investments.

Kommunalbanken AS

About the company

Kommunalbanken offers long-term loan financing to the municipal sector. The enterprise was established in 1926 and converted into a limited liability company in 1999. Kommunalbanken’s head office is in Oslo.

At year-end 2021, the company had 94 employees and book equity of NOK 19 billion. Interest income in 2021 was NOK 3.5 billion.

State ownership

The State’s rationale for ownership in Kommunalbanken is to offer stable, long-term and effective financing to the municipal sector. The State owns 100 per cent of the shares in Kommunalbanken.

The State’s goal as owner is the highest possible return over time in a sustainable manner.

Special framework conditions for the company

The purpose of the company is to only provide loans to municipal and county authorities, IKS (intermunicipal companies) and other companies that undertake local authority business, against a local or central government guarantee or other suitable security.

Kongsberg Gruppen ASA

About the company

Kongsberg Gruppen supplies high technology systems and solutions to customers in the energy, offshore, shipping, fisheries, defence and space industries. The company is a continuation of the State-owned Kongsberg Våpenfabrikk, which was dissolved in 1987. Kongsberg Gruppen is listed on the Oslo Stock Exchange and has its head office in Kongsberg.

At year-end 2021, the company had 11,122 employees and a market value of NOK 51.1 billion. Operating revenues in 2021 were NOK 27.4 billion.

State ownership

The State’s rationale for ownership in Kongsberg Gruppen is to maintain a high-tech industrial company with head office functions in Norway and to have control of a strategic defence industry supplier. The State owns 50.004 per cent of the shares in Kongsberg Gruppen.

The State’s goal as owner is the highest possible return over time in a sustainable manner.

Mantena AS

About the company

Mantena provides maintenance services to train operators in the Nordic region, primarily the maintenance of locomotives, carriages and multiple units. The company also maintains components and maintains and repairs rolling stock. The company was demerged from Vygruppen AS in 2017. Mantena’s head office is in Oslo.

At year-end 2021, the company had 967 employees and book equity of NOK 204 million. Operating revenues in 2021 were NOK 1.6 billion.

State ownership

The State’s rationale for ownership in Mantena is to have a provider of maintenance and workshop services for rolling stock. The State owns 100 per cent of the shares in Mantena.

The State’s goal as owner is the highest possible return over time in a sustainable manner.

Mesta AS

About the company

Mesta is Norway’s largest contracting company in the operation and maintenance of roads. The company also has extensive activities within road and rail construction projects such as tunnel rehabilitation, rock and landslide protection, wharf and bridge maintenance and road safety. Mesta is also the largest operator within electrical engineering on roads and tunnels. The company was divested from the Norwegian Public Roads Administration in 2003. Mesta’s head office is situated in Bærum.

At year-end 2021, the company had 1,696 employees and book equity of NOK 652 million. Operating revenues in 2021 were NOK 5.3 billion.

State ownership

The State’s rationale for ownership in Mesta is that the company possesses important expertise for the operation and maintenance of transport infrastructure. The State owns 100 per cent of the shares in Mesta.

The State’s goal as owner is the highest possible return over time in a sustainable manner.

Nammo AS

About the company

Nammo supplies high-technology products to the aerospace and defence industry. The core business includes the development and production of rocket motors, military and sports ammunition, shoulder-launched weapons systems and environmentally-friendly demilitarisation services. The company was founded in 1998 through a merger of Nordic munitions companies with a view to strengthen security of supply in the Nordic region. Nammo’s head office is at Raufoss in Vestre Toten.

At year-end 2021, the company had 2,662 employees and book equity of NOK 3.2 billion. Operating revenues in 2021 were NOK 7 billion.

State ownership

The State’s rationale for ownership in Nammo is to maintain a high-tech industrial company with head office functions in Norway and to have control of a strategic defence industry supplier with a significant part of its activities in Norway. The State owns 50 per cent of the shares in Nammo. The State has a shareholder agreement with Patria Oyj, which owns 50 per cent of the company, that grants the owners extended shareholder rights.

The State’s goal as owner is the highest possible return over time in a sustainable manner.

Norsk Hydro ASA

About the company

Norsk Hydro (Hydro) is a leading aluminium and energy company with operations throughout the entire aluminium value chain, from energy production to bauxite extraction and alumina refining, the production of primary aluminium, aluminium extrusions and aluminium recycling. The State acquired a major stake in Hydro following the Second World War. Hydro is listed on the Oslo Stock Exchange and is headquartered in Norway.

At year-end 2021, the company had 31,264 employees and a market value of NOK 144 billion. Operating revenues in 2021 were NOK 150 billion.

State ownership

The State’s rationale for ownership in Hydro is to maintain a leading industrial company with head office functions in Norway. The State owns 34.26 per cent of the shares in Hydro.

The State’s goal as owner is the highest possible return over time in a sustainable manner.

Nysnø Klimainvesteringer AS

About the company

Nysnø Klimainvesteringer (Nysnø) aims to help reduce greenhouse gas emissions by making investments that directly or indirectly contribute to this. The company invests in non-listed companies and funds aimed at non-listed companies with business operations in or out of Norway. The investment universe includes companies that are in early phases of development and the investments are primarily concentrated on new technology in the transition from technological development to commercialisation. The company was established in 2017 and has been operational since autumn 2018. Nysnø’s head office is in Stavanger.

At year-end 2021, the company had 12 employees and book equity of NOK 2.5 billion. Operating revenues in 2021 were NOK 89 million.

State ownership

The State’s rationale for ownership in Nysnø is to contribute to capital access for companies in an early phase of development that reduces greenhouse gas emissions. The State owns 100 per cent of the shares in Nysnø.

The State’s goal as owner is the highest possible return over time in a sustainable manner.

Special framework conditions for the company

The company’s articles of association specify special guidelines for the company’s investments.

Posten Norge AS

About the company

Posten Norge is one of the largest mail and logistics groups in the Nordic region. The company is positioning itself for long-term growth in the logistics segment, particularly within e-commerce, through investments in innovation and sustainability. Posten Norge markets itself using two brands: Posten, which is the service offered to the Norwegian people, and Bring, which is the service offered to all corporate customers and private customers outside of Norway. The company’s head office is situated in Oslo.

At year-end 2021, the company had 12,561 employees and book equity of NOK 7.3 billion. Operating revenues in 2021 were NOK 24.7 billion.

State ownership

The State’s rationale for ownership in Posten Norge is to maintain nationwide statutory postal services in Norway. The State owns 100 per cent of the shares in Posten Norge.

The State’s goal as owner is the highest possible return over time in a sustainable manner.

Special framework conditions for the company

The Ministry of Transport has appointed Posten Norge as the provider with a duty to deliver postal services. The State exercises its authority by purchasing services from Posten Norge to ensure nationwide provision of postal services. The State regulates the content and quality of the services through the Postal Services Act.

Statkraft SF

About the company

Statkraft is Europe’s largest producer of renewable energy and a major player in the European energy market. The focal point of Statkraft’s activities is in Norway through the company’s Norwegian hydropower business. The company can also invest in profitable projects internationally and has production and trading activities in a number of other European countries, as well as selected markets in Asia and South America. The company was divested from Statskraftverkene in 1992. Statkraft’s head office is in Oslo.

At year-end 2021, the company had 4,782 employees and book equity of NOK 105 billion. Operating revenues in 2021 were NOK 41.3 billion.

State ownership

The State’s rationale for ownership in Statkraft is to own Norwegian hydropower resources and maintain a leading energy company with head office functions in Norway. The State owns 100 per cent of Statkraft.

The State’s goal as owner is the highest possible return over time in a sustainable manner.

Statkraft is a company that plays an important role in the development of renewable energy. In light of the State’s rationale for ownership and the fact that Statkraft is a wholly-owned state company, the State has a particular focus on the company appropriately assessing and balancing risk in its future growth plans, including with regard to demanding markets.

Telenor ASA

About the company

Telenor is a global mobile operator with 172 million mobile subscriptions. The company was established in 1994 through the conversion of Televerket into a limited liability company. Telenor is listed on the Oslo Stock Exchange and has its head office in Bærum.

At year-end 2021, the company had 16,000 employees and a market value of NOK 194 billion. Operating revenues in 2021 were NOK 110 billion.

State ownership

The State’s rationale for ownership in Telenor is to maintain a leading telecommunications company with head office functions in Norway, and to have control of communications infrastructure that is critical to society. The State owns 53.97 per cent of the shares in Telenor.

The State’s goal as owner is the highest possible return over time in a sustainable manner.

Vygruppen AS

About the company

Vygruppen (Vy) is a transport group with operations in Norway and Sweden. Activities consist of rail passenger services, rail freight transport and bus services, as well as other activities with a natural connection to this. The company was divested from the State in 1996 and has been organised as a State-owned limited company since 2002. Vy’s head office is in Oslo.

At year-end 2021, the company had 12,457 employees and book equity of NOK 3 billion. Operating revenues in 2021 were NOK 15.3 billion.

State ownership

The State’s rationale for ownership in Vy is to have a provider that can meet the State’s need for the transport of passengers and freight by rail. The State owns 100 per cent of the shares in Vy.

The State’s goal as owner is the highest possible return over time in a sustainable manner.

For passenger rail transport covered by the negotiations with the Norwegian Railway Directorate for the direct allocation of transport agreements for Eastern Norway, the State’s goal as owner is sustainable and the most efficient possible attainment of public policy goals.

Special framework conditions for the company

In its role as sector authority, the Ministry of Transport is responsible for setting the framework conditions for Vy’s activities as a rail operator. This takes place via the national budget, the agency management of the Norwegian Railways Directorate as coordinating operator for the railway sector and management of sector-specific laws and regulations. Via the Norwegian Railway Directorate, the State currently purchases services from Vy and other rail operators in order to have a nationwide passenger rail service. The content and quality of the services depend on how much the State is willing to pay for the services. This is decided in connection with the annual national budgets. The State achieves its public policy goal through purchases of passenger rail services and other regulations.

The Government has decided to cease further competitive tendering of passenger rail transport. The operation of the rail service in Eastern Norway has been divided into two packages, Østlandet 1 and Østlandet 2, and these will be allocated directly to Vy and/or Flytoget.

Yara International ASA

About the company

Yara International (Yara) is a global leading crop nutrition company with a portfolio of nitrogen-based products for industrial use. Yara is listed on the Oslo Stock Exchange and is headquartered in Oslo.

At year-end 2021, the company had 17,800 employees and a market value of NOK 113 billion. Operating revenues in 2021 were NOK 143 billion.

State ownership

The State’s rationale for ownership in Yara is to maintain a leading industrial company with head office functions in Norway. The State owns 36.21 per cent of the shares in Yara.

The State’s goal as owner is the highest possible return over time in a sustainable manner.

7.2 The companies in Category 2

Andøya Space AS

About the company

Andøya Space provides services relating to space and atmospheric research, environmental monitoring and technology testing and verification. The company also contributes to knowledge development and interest in these areas. The company is in the process of establishing a launch base for small satellites at Andøya. The Norwegian Armed Forces are a significant customer of Andøya Space for activities related to testing and training activities with missiles and other advanced weapon systems. Andøya Space has roots that date back to when the undertaking was established in 1962 and was split off as a limited liability company in 1997. The head office is in Andøya.

At year-end 2021, the company had 130 employees and book equity of NOK 146 million. Operating revenues in 2021 were NOK 173 million.

State ownership

The State’s rationale for ownership in Andøya Space is to have national control of a launch complex for small satellites and testing facilities for the Norwegian Armed Forces and Norwegian defence industry, as well as to ensure that Norwegian business and industry, research communities and public administration have good access to infrastructure for testing technology and scientific research and dissemination. The State owns 90 per cent of the shares in Andøya Space.

The State’s goal as owner for the part of the activities financed through basic allocations via the national budget and through the international Esrange Andøya Special Project (EASP) agreement is efficient operations and enhanced Norwegian technological and scientific expertise. For activities that are in competition with others, the State’s goal is the highest possible return over time in a sustainable manner.

Special framework conditions for the company

About 25 per cent of the company’s revenues originate from the EASP Agreement. The EASP Agreement is a multilateral agreement between Germany, France, Switzerland, Sweden and Norway. The countries that participate in the project pay an annual contribution to fund launch activities for researchers from the respective countries. The EASP Agreement guarantees a basic income for the rocket launch site on Andøya.

The subsidiary Andøya Space Education AS receives an annual basic allocation from the Directorate of Education with the associated grant letter.

Avinor AS

About the company

Avinor owns, operates and develops a nationwide network of airports for the civilian sector and provides a joint air navigation service for both civilian and military aviation. The company’s activities encompasses 45 airports in Norway, including control towers, control centres and other technical infrastructure for flight navigation. Avinor also has commercial revenues from services provided in connection with the airports. The company was established in 2003 through the conversion of the public sector enterprise Norwegian Civil Aviation Authority (Luftsfartsverket). Avinor’s head office is in Oslo.

At year-end 2021, the company had 2,744 employees and book equity of NOK 12.5 billion. Operating revenues in 2021 were NOK 9.3 billion.

State ownership

The State’s rationale for ownership in Avinor is to ensure the operation and development of a nationwide network of airports, as well as civil and military air navigation services. The State owns 100 per cent of the shares in Avinor.

The State’s goal as owner is a cost-efficient, safe operation and development of State-owned airports and air navigation services.

Special framework conditions for the company

Avinor’s activities are part of the State’s overall sectoral policy in the area of aviation. In its role as owner, the Ministry of Transport decides which airports the company will develop and operate. Avinor also has to perform socially mandated tasks in accordance with the instructions from the Ministry of Transport as owner and sector authority. These tasks include an emergency ambulance service.

In its role as sector authority, the Ministry of Transport sets the framework for Avinor’s activities through the National Transport Plan and by the Ministry regulating Avinor’s tax revenues, granting licences to Avinor’s airports, designating Avinor as a provider of air navigation services, and being responsible for safety regulations, etc., in connection with aviation.

Avinor receives revenues from airport and air navigation services in the form of charges paid by the airlines. The regulated revenues normally account for just under half of Avinor’s total revenues, while other revenues are linked to commercial activities. A co-funding arrangement is used between the airports, which entails that unprofitable airports are financed by the profit generated by profitable airports, especially Oslo Airport.

Bane NOR SF

About the company

Bane NOR is responsible for the planning, development, management, operation and maintenance of the national rail network, for traffic management, and for the management and development of railway property. The rail and property activities, including the property activities organised in the subsidiary Bane NOR Eiendom AS, shall together support the company’s objectives. Bane NOR was founded in 2016, and in 2017, the majority of the activities of the administrative agency the Norwegian National Rail Administration (Jernbaneverket) were transferred to Bane NOR. In 2017, Bane NOR also transferred its property activities to ROM Eiendom AS from Vygruppen AS. Bane NOR’s head office is in Oslo.

At year-end 2021, the company had 3,335 employees and book equity of NOK 11.8 billion. Operating revenues in 2021 were NOK 14.3 billion.

State ownership

The State’s rationale for ownership in Bane NOR is to ensure the management and development of national railway infrastructure and railway property. The State owns 100 per cent of Bane NOR.

The State’s goal as owner is cost-effective management and development of a safe and accessible railway infrastructure and railway-related property activities based on socio-economic profitability assessments. For the commercial property activities, the State’s goal as an owner is the highest possible return over time in a sustainable manner.

Special framework conditions for the company

Bane NOR’s activities are part of the State’s overall sectoral policy in the railway sector, which are carried out in cooperation between the Ministry of Transport, the Norwegian Railway Directorate and Bane NOR. The Ministry of Transport has overall responsibility for strategic management of the sector. This takes place through the Ministry’s role as owner and sector authority. The Norwegian Railway Directorate has been assigned responsibility for the overall coordination of the railway sector. Among other things, this includes responsibility for long-term planning and for entering into and following up commercial agreements with stakeholders in the railway sector.

In its role as sector authority, the Ministry of Transport sets the framework conditions for Bane NOR’s activities through the national budget and the National Transport Plan. As sector authority, the Ministry of Transport also sets the framework for Bane NOR’s activities through agency management of the Norwegian Railway Directorate, administration of the Ministry’s overarching agreement with Bane NOR, and administration of sector-specific statutes and regulations.

Through the Ministry of Transport, the State has entered into an overarching agreement with Bane NOR which assigns the company responsibility for results and compliance with financial frameworks. The underlying agreements between the Norwegian Railway Directorate and Bane NOR for the purchase of services are executed within the framework of the Ministry of Transport’s overarching agreement with the company. Bane NOR is primary financed by appropriations via the national budget. The Norwegian Railway Directorate is allocated its budgets by allocation letter and then enters into agreements for the purchase of services that reflect the Storting’s appropriation decisions.

Bjørnøen AS

About the company

Bjørnøen owns all the land and some buildings of cultural historical value on Bjørnøya island. Bjørnøya is a nature reserve and most of the island is protected. Bjørnøen was taken over by the State in 1932 and placed under the management of Kings Bay AS, which also provides management services to Bjørnøen, in 1967. Bjørnøen’s head office is in Ny-Ålesund.

At year-end 2021, the company had no employees and book equity of NOK 4.1 million. Operating revenues in 2021 were NOK 0.2 million.

State ownership

The State’s rationale for ownership in Bjørnøen is to manage the State’s ownership of the land on Bjørnøya. The State owns 100 per cent of the shares in Bjørnøen.

The State’s goal as owner is to manage the State’s ownership of the land on Bjørnøya.

Carte Blanche AS

About the company

Carte Blanche is Norway’s national company of contemporary dance and the only permanent contemporary dance ensemble in Norway. The company was established in 1988 and produces and presents performances created by renowned and new Norwegian and international contemporary dance choreographers. Carte Blanche is located in Bergen.

At year-end 2021, the company had 32 employees and book equity of NOK 12.4 million. Operating revenues in 2021 were NOK 45.1 million.

State ownership

The State’s rationale for ownership in Carte Blanche is to contribute to ensuring that everyone has access to dramatic art. The State owns 70 per cent of the shares in Carte Blanche.

The State’s goal as an owner is a high level of artistic quality to a wide audience.

Special framework conditions for the company

The company is primary funded through public grants. The Ministry of Culture and Equality sets the goals, framework conditions and guidelines for its share of the grant in an annual grant letter.

AS Den Nationale Scene

About the company

Den Nationale Scene (DNS) is one of Norway’s five national dramatic art institutions. The theatre’s vision is to create engaging, entertaining and relevant theatre of high artistic quality for a broad audience. The theatre is an extension of Ole Bull’s Det Norske Theater, which was established in 1850. The State became part-owner in 1972. Den Nationale Scene is located in Bergen.

At year-end 2021, the company had 134 employees and book equity of NOK 75.5 million. Operating revenues in 2021 were NOK 160 million.

State ownership

The State’s rationale for ownership in Den Nationale Scene is to contribute to ensuring that everyone has access to dramatic art. The State owns 66.67 per cent of the shares in Den Nationale Scene.

The State’s goal as an owner is a high level of artistic quality to a wide audience.

Special framework conditions for the company

The company is primary funded through public grants. The Ministry of Culture and Equality sets the goals, framework conditions and guidelines for its share of the grant in an annual grant letter.

Den Norske Opera & Ballett AS

About the company

Den Norske Opera & Ballett AS, the Norwegian National Opera & Ballet, is Norway’s largest institution for music and the dramatic arts, with Oslo Opera House as the main arena for presenting this. The company was established in 1957.

At year-end 2021, the company had 630 employees and book equity of – NOK 26.7 million. Operating revenues in 2021 were NOK 719 million.

State ownership

The State’s rationale for ownership in Den Norske Opera & Ballett is to contribute to ensuring that everyone has access to opera and ballet. The State owns 100 per cent of the shares in Den Norske Opera & Ballett.

The State’s goal as an owner is a high level of artistic quality to a wide audience.

Special framework conditions for the company

The company is primary funded through grants from the State. The Ministry of Culture and Equality sets the goals, framework and guidelines for the grant in an annual grant letter.

Electronic Chart Centre AS

About the company

Electronic Chart Centre (ECC) contributes to improved safety at sea, on land and in the air, through the development and operation of a database of electronic navigational charts. The company was divested from the Norwegian Mapping Authority in 1999 and makes a contribution to Norway’s leading role in maritime safety. ECC’s head office is in Stavanger.

At year-end 2021, the company had 19 employees and book equity of NOK 5.9 million. Operating revenues in 2021 were NOK 33.4 million.

State ownership

The State’s rationale for ownership in ECC is to ensure the management and provision of authorised electronic navigational data, which is an exclusive right granted to the company. This exclusive right relates to the operation of the intergovernmental PRIMAR Partnership. The State owns 100 per cent of the shares in ECC.

The State’s goal as owner is safe and efficient maritime transport by managing and providing authorised electronic navigational data.

Special framework conditions for the company

Most of ECC’s revenues stem from an agreement with the Norwegian Mapping Authority concerning the development and operation of electronic nautical charts for PRIMAR. PRIMAR is a collaboration on official chart data that involves several countries. The agreement between PRIMAR and ECC was entered into based on an internal scheme for public purchase arrangements (‘utvidet egenregi’).

Enova SF

About the company

Enova’s primary policy instrument is investment support. The company’s tasks are outlined in more detail in an agreement between the Ministry of Climate and Environment and Enova on the management of the Climate and Energy Fund. The company was established in 2001. Enova’s head office is in Trondheim.

At year-end 2021, the company had 82 employees and book equity of NOK 36.1 million. Operating revenues in 2021 were NOK 152 million.

State ownership

The State’s rationale for ownership in Enova is to compensate for a number of market failures related to, among other things, the development and introduction of new climate and energy technologies and solutions. The State owns 100 per cent of Enova.

The State’s goal as owner is making the most effective possible contribution towards meeting Norway’s climate commitments and the transition to a low-emissions society, in line with the applicable management agreement.

Special framework conditions for the company

Enova manages the Climate and Energy Fund, which is intended to be a long-term source of funding for the activities. The Climate and Energy Fund is funded by a parafiscal charge on electricity grid tariffs, transfers via the national budget and interest earned on the balance of capital.

Enova was established in order to effectively utilise the funds that have been made available. The primary element is overarching management through four-year management agreements between the Ministry of Climate and Environment and Enova for the funds from the Climate and Energy Fund. The agreement sets the framework for Enova’s operations, targets for the activities and requirements for reporting. The management agreement gives Enova a long-term financial framework and considerable professional freedom to focus its efforts on areas that provide the greatest opportunities for influencing developments. The annual budget framework for Enova’s operations is determined in the annual letter of assignment from the Ministry of Climate and Environment.

Entur AS

About the company

Entur develops and supplies digital infrastructure and related services within travel planning and ticket sales in the public transport sector. The company offers a competition-neutral, national travel planning service that is intended to make it easy for travellers to plan and purchase tickets for journeys, irrespective of whether the journey involves one or more public transport companies. Entur cooperates with the public transport operators to collect, refine and share public transport data for all of Norway on an open digital platform. In addition, Entur works together with several transport enterprises to better utilise data in the transport sector. The company was demerged from Vygruppen AS in 2017. Entur simultaneously took over responsibility for services which were previously supplied by Norsk Reiseinformasjon AS, along with ownership of the company Interoperabilitetstjenester AS. These companies provided services within the collection and publication of timetable data and electronic ticketing. Entur’s head office is in Oslo.

At year-end 2021, the company had 260 employees and book equity of NOK 93 million. Operating revenues in 2021 were NOK 557 million.

State ownership

The State’s rationale for ownership in Entur is to develop and supply digital infrastructure and related travel planning and ticketing services for rail companies and other the public transport operators nationwide, including to manage ticket sales and being able to provide competition-neutral travel information to public transport passengers. The State owns 100 per cent of the shares in Entur.

The State’s goal as owner is cost-efficient development and operation of travel planning and ticketing services for the public transport sector.

Special framework conditions for the company

Entur’s activities are part of the State’s overall sectoral policy in the railway sector. In its role as sector authority, the Ministry of Transport sets the framework conditions for Entur’s activities through the national budget and the National Transport Plan. As a sector authority, the Ministry of Transport also sets the framework conditions for Entur’s activities through agency management of the Norwegian Railway Directorate as coordinating operator for the rail sector and administration of sector-specific statutes and regulations.

The Norwegian Railway Directorate requires passenger train companies that have traffic agreements with the State to enter into an agreement with Entur for providing ticketing services. Entur’s revenues in these areas are therefore covered by State appropriations for publicly purchased passenger rail transport.

In addition, the Norwegian Railway Directorate enters into an agreement for the purchase of services from Entur related to the collection and publication of public transport data, the development and operation of a national travel planning service and electronic ticket sales for other public transport services. These tasks are partly financed via the national budget and partly by a fee collected by the Norwegian Railway Directorate.

Entur has been commissioned by the Ministry of Transport as sector authority to coordinate and contribute to cross-sectoral cooperation on data in the transport sector, and the company is responsible for managing the funds allocated for this cooperation.

Filmparken AS

About the company

Filmparken offers facilities for recording films, including studios and offices, in Jar in Bærum. The State has been involved in film production and studio operations in Jar since 1948.

At year-end 2021, the company had eight employees and book equity of NOK 25 million. Operating revenues in 2021 were NOK 15 million.

State ownership

The State’s rationale for ownership in Filmparken is to facilitate the production of films in Norway. The State owns 77.6 per cent of the shares in Filmparken, while the City of Oslo owns 11.6 per cent. The remaining 10.8 per cent of the shares are owned by around 80 municipalities and one bank.

The State’s goal as owner is high-quality film production.

Fiskeri- og havbruksnæringens forskningsfinansiering AS

About the company

Fiskeri- og havbruksnæringens forskningsfinansiering (FHF) manages funds for industry-based research and development. The undertaking was established in 2000 and converted into a limited liability company in 2019. FHF’s head office is in Tromsø.

At year-end 2021, the company had 18 employees and book equity of NOK 111 million. Operating revenues in 2021 were NOK 363 million.

State ownership

The State’s rationale for ownership in FHF is to strengthen funding of marine research and development. The State owns 100 per cent of the shares in FHF.

The State’s goal as owner is to facilitate increased value creation, environmental adaptation, restructuring and innovation in the fisheries and aquaculture industry.

Special framework conditions for the company

FHF is financed by the fisheries and aquaculture industry through a statutory research levy on the export value of fish and fish products, cf. Act No. 68 of 7 July 2000 relating to a Research and Development Levy in the Fisheries and Aquaculture Industry. Use of the funds is regulated by the Regulations relating to a Research and Development Levy in the Fisheries and Aquaculture Industry.

Gassco AS

About the company

Gassco is the operator for the integrated gas transport system from the Norwegian continental shelf to Europe. The gas transport system is a natural monopoly that consists of pipelines, processing facilities, platforms and gas terminals on the European continent and in the UK. Gassco conducts activities on behalf of the gas infrastructure owners on their account and risk. The shippers pay regulated transport tariffs that provide the owners with a reasonable return. Gassco does not make a profit or loss from its operations. The company was established in 2001. Gassco’s head office is at Karmøy.

At year-end 2021, the company had 359 employees and book equity of NOK 15 million. Operating revenues in 2021 were zero.

State ownership

The State’s rationale for ownership in Gassco is to ensure a single neutral and independent operator for the integrated gas transport system and to facilitate efficient utilisation of the resources on the Norwegian continental shelf. The State owns 100 per cent of the shares in Gassco.

The State’s goal as owner is the efficient operation and comprehensive further development of the gas transport system on the Norwegian continental shelf.

Special framework conditions for the company

Gassco has general and special responsibilities as operator. The general operatorship involves the management of processing facilities, pipelines, platforms and gas terminals pursuant to Act No. 72 of 29 November 1996 relating to Petroleum Activities and requirements set out in legislation relating to health, safety and the environment. The general operatorship is exercised on behalf of the gas infrastructure owners at their expense and risk. The special operatorship involves tasks relating to system operation, capacity administration and infrastructure development, cf. the Petroleum Activities Act and Petroleum Regulations.

The costs of operating the transport system are covered by the users through a tariff, cf. the Regulations relating to the Stipulation of Tariffs etc. for Certain Facilities, which also provides the owners with a reasonable return on the capital invested. Gassco does not make a profit or loss from its operations.

Gassnova SF

About the company

Gassnova manages the State’s interests relating to the capture, transport and geological storage of carbon dioxide. This includes promoting technological development and the development of expertise for cost-effective, forward-looking CCS solutions, and acting as an advisor to the Ministry of Petroleum and Energy in the work with CCS. Gassnova was established as a government agency in 2005 and converted into a state enterprise in 2007. The subsidiary TCM Assets AS was established in 2017 and has the objective of owning and leasing facilities for CO2 to an operating company (TCM DA). Gassnova’s head office is in Porsgrunn.

At year-end 2021, the company had 37 employees and book equity of NOK 78.6 million. Operating revenues in 2021 were NOK 129 million.

State ownership

The State’s rationale for ownership in Gassnova is to safeguard the State’s interests relating to carbon capture and storage (CCS). The State owns 100 per cent of Gassnova.

The State’s goal as owner is to contribute to technological development and the development of expertise for cost-effective, forward-looking CCS solutions.

Special framework conditions for the company

The company is primarily funded via the national budget. The Ministry of Petroleum and Energy stipulates guidelines for the funds and the company’s activities in an annual letter of assignment.

Graminor AS

About the company

Graminor’s social mission is to deliver new plant varieties to the agricultural and horticultural industries that are suited to Norwegian and Nordic growing conditions. This assignment involves the development of Norwegian plant varieties, representation and testing of foreign varieties and pre-base production. Graminor’s head office is located at Bjørke Forsøksgård in Hamar.

At year-end 2021, the company had 36 employees and book equity of NOK 77.1 million. Operating revenues in 2021 were NOK 80 million.

State ownership

The State’s rationale for ownership in Graminor is to deliver new plant varieties to the agricultural and horticultural industries that are suited to the Norwegian and Nordic climate in order to contribute to food security in Norway. The state owns 28.2 per cent of the shares in Graminor.

The State’s goal as owner is the sustainable and most efficient possible development of high-quality plant varieties. Activities in competition with others must be managed with the same goals as the State’s overarching goals as owner of companies that primarily operate in competition with other companies (Category 1).

Special framework conditions for the company

Through the Agricultural Agreement, the State supports plant breeding programmes that are socio-economically profitable and important for the agriculture and horticulture industry, but not commercially profitable. Graminor applies for such support from the Norwegian Agriculture Agency, which issues a grant letter when funds are granted.

Innovasjon Norge (special-legislation company)

About the company

Innovasjon Norge’s statutory objective is to act as a policy instrument used by the State and county authorities to realise value-creating business development throughout Norway. The company administers business-oriented schemes on behalf of various ministries, county authorities and other public stakeholders. The schemes have the same main objective of triggering commercially and socio-economically profitable business development and unleashing regional business opportunities. Innovasjon Norge was established in 2003 and is headquartered in Oslo.

At year-end 2021, the company had 749 employees and book equity of NOK 1.6 billion. Operating revenues in 2021 were NOK 1.3 billion.

State ownership

The State’s rationale for ownership in Innovasjon Norge is to provide the business sector with business-oriented schemes in order to spur commercially and socio-economically profitable business development, including business opportunities in the regions. The State owns 51 per cent of Innovasjon Norge, while the county authorities own 49 per cent of the company.

The State’s goal as owner is to trigger commercially and socio-economically profitable business development throughout the country.

Special framework conditions for the company

The company’s activities are regulated by Act No. 130 of 19 December 2003 relating to Innovasjon Norge. Innovasjon Norge is a key player in the policy instrument system for the business sector and conducts its activities in close cooperation with the authorities and other policy instrument actors. The company’s activities are primarily financed by grants, user fees and market revenues from its public assignments. Innovasjon Norge’s loans are financed through credit from the State. The company’s assignments are specified and established in separate letters of assignment.

Kimen Såvarelaboratoriet AS

About the company

Kimen Såvarelaboratoriet AS (Kimen) is Norway’s centre of expertise relating to seed quality and seed analysis and is the national reference laboratory for seed analysis. The undertaking has existed for more than 130 years and was converted into a limited liability company in 2004. The laboratory is accredited by ISTA (International Seed Testing Association) for germination analysis, seed health, purity and moisture content determination of all relevant seeds and can issue international seed certificates. The laboratory is the only one of its kind in Norway and the accreditation guarantees quality and national expertise within this specialist field. Kimen’s head office is located in Ås.

At year-end 2021, the company had 19 employees and book equity of NOK 10.6 million. Operating revenues in 2021 were NOK 14.2 million.

State ownership

The State’s rationale for ownership in Kimen is to maintain a national centre of expertise in seed quality and seed analysis in Norway. The State owns 51 per cent of the shares in Kimen.

The State’s goal as owner is the most efficient and high-quality seed analyses and services. Activities in competition with others must be managed with the same goals as the State’s overarching goals as owner of companies that primarily operate in competition with other companies (Category 1).

Special framework conditions for the company

The Norwegian Food Safety Authority has a knowledge support agreement with Kimen and purchases services from Kimen through this agreement.

Kings Bay AS

About the company

Kings Bay owns and is responsible for operating and developing the infrastructure in Ny-Ålesund. The company’s operations include accommodation, catering, organising air transport services, maritime services, emergency preparedness, engineering services and water and electricity supply. Ten research communities from different nations are permanently based in Ny-Ålesund, and every year approximately 20 different research communities carry out research projects in and around Ny-Ålesund. The company’s head office is in Ny-Ålesund.

At year-end 2021, the company had 29 employees and book equity of NOK 22 million. Operating revenues in 2021 were NOK 82.2 million.

State ownership

The State’s rationale for ownership in Kings Bay is to have a Norwegian research station in Ny-Ålesund for international world-class research collaborations that contribute to supporting the overarching objectives of Norway’s Svalbard policy. The State owns 100 per cent of the shares in Kings Bay.

The State’s goal as owner is that the company’s properties, buildings and infrastructure are operated, maintained and developed as efficiently as possible to enable Ny Ålesund research station to develop as a Norwegian platform for international world-class research collaboration.

Special framework conditions for the company

The State’s Svalbard policy and the framework conditions defined for the development of activities in Ny-Ålesund have a bearing on the company’s activities. Furthermore, the Government’s policy for research and higher education on Svalbard and the research strategy for Ny-Ålesund define the framework conditions for the research conducted there, and thereby also for the company’s activities. The company receives an annual grant from the Ministry of Climate and Environment with the associated grant letter relating to major investments and, if applicable, operations.

Nationaltheatret AS

About the company

Nationaltheatret is one of five national dramatic art institutions in Norway and develops Norwegian dramatic art. The theatre’s performances aim to be bold and relevant, and the theatre shall be open and engaging to the public. The theatre was established in 1899 and became State-owned in 1972. Nationaltheatret is located in Oslo.

At year-end 2021, the company had 324 employees and book equity of NOK 7.9 million. Operating revenues in 2021 were NOK 280 million.

State ownership

The State’s rationale for ownership in Nationaltheatret is to contribute to ensuring that everyone has access to dramatic art. The State owns 100 per cent of the shares in Nationaltheatret.

The State’s goal as an owner is a high level of artistic quality to a wide audience.

Special framework conditions for the company

The company is primary funded through grants from the State. The Ministry of Culture and Equality sets the goals, framework and guidelines for the grant in an annual grant letter.

Nofima AS

About the company

Nofima is an industry-oriented research institute that emphasises the practical application of research results. The company helps to ensure that new research-based knowledge and ideas with commercial potential create jobs through sustainable production, new products and services. Nofima conducts research on assignment for the aquaculture industry, the fisheries industry, the onshore and offshore-based food industry, the supplier industry, the feed supplier and ingredients industry, and public administration. The company was founded in 2008. Nofima’s head office is in Tromsø.

At year-end 2021, the company had 393 employees and book equity of NOK 217 million. Operating revenues in 2021 were NOK 677 million.

State ownership

The State’s rationale for ownership in Nofima is to facilitate research activity and research infrastructure in the aquaculture, fisheries and food industries, in areas that are not funded by the market and that are of importance to society. The State owns 56.8 per cent of the shares in Nofima.

The State’s goal as owner is the highest possible value creation from the company’s research activities.

Special framework conditions for the company

The Ministry of Trade, Industry and Fisheries allocates grants for the company and issues the pertaining letter of allocation, among other things to safeguard the research infrastructure.

Nordisk Institutt for Odontologiske Materialer AS

About the company

Nordisk Institutt for Odontologiske Materialer AS (Nordic Institute of Dental Materials) (NIOM) is a Nordic cooperative body for dental biomaterials. The company’s research, material testing, standardisation and research-based educational activities target the dental health services and health authorities in the Nordic countries. NIOM helps to ensure that patients in the Nordic countries receive safe, well-functioning biomaterials. The undertaking was established in 1972 as an institute organised under the Nordic Council of Ministers and was converted into a limited liability company in 2009. NIOM’s head office is located in Oslo.

At year-end 2021, the company had 28 employees and book equity of NOK 18.8 million. Operating revenues in 2021 were NOK 41 million.

State ownership

The State’s rationale for ownership in NIOM is to ensure Nordic influence in the management of the company. The State owns 49 per cent of the shares in NIOM. Norwegian Research Centre owns 51 per cent of the shares.

The State’s goal as an owner is to contribute to the best possible quality and patient safety in the use of dental materials in the Nordic countries.

Special framework conditions for the company

The Directorate of Health and the Nordic Council of Ministers provide grants for the company and issue the pertaining letters of allocation.

Norfund (special-legislation company)

About the company

Norfund is the State’s investment fund for business development in developing countries. The company invests venture capital in sustainable businesses, which contributes to economic development and job creation through viable and profitable businesses. Returns on the investment portfolio are reinvested. The company was established in 1997. Norfund’s head office is in Oslo.

At year-end 2021, the company had 111 employees and book equity of NOK 32.1 billion. Operating revenues in 2021 were NOK 6 billion.

State ownership

The State’s rationale for ownership in Norfund is to have a targeted policy instrument that can develop viable and profitable business activities in developing countries that would otherwise not have been initiated due to the high risk. The State owns 100 per cent of Norfund.

The State’s goal as owner is to stimulate increased employment and sustainable economic development in developing countries Norfund also manages the Climate Investment Fund, for which the State’s goal is the highest possible reduction or avoidance of greenhouse gas emissions by investing in renewable energy in developing countries.

Special framework conditions for the company

Norfund’s activities and investments are regulated by Act No. 26 of 9 May 1997 relating to the Norwegian Investment Fund for Developing Countries and the company’s articles of association. Norfund shall be a minority investor and prioritise investments in Sub-Saharan Africa and the least developed countries in renewable energy and risk-exposed sectors that yield particularly high development effects.

Norfund has been allocated funds via the national budget since its formation. The company is not subject to earnings requirements over and above the profitable business requirement.

Norges sjømatråd AS

About the company

Norges Sjømatrådet (Norwegian Seafood Council) shall promote the value of Norwegian seafood through joint marketing, work on market information, market access, PR/information and preparedness. The company shall also seek to develop new and further exploit established markets and strengthen and cement the reputation of Norwegian seafood. The company was founded in 1991. Norges sjømatråd’s head office is in Tromsø.

At year-end 2021, the company had 72 employees and book equity of NOK 305 million. Operating revenues in 2021 were NOK 467 million.

State ownership

The state’s rationale for ownership in Norges sjømatråd is to facilitate joint marketing, market information and market access that will contribute to greater volumes and increased revenues from the export of Norwegian seafood. The State owns 100 per cent of the shares in Norges sjømatråd.

The State’s goal as owner is to maximise the export value of Norwegian seafood.

Special framework conditions for the company

The company is financed through a statutory market fee on all exports of Norwegian fish and seafood, cf. Act No. 9 of 27 April 1990 relating to the Regulation of Exports of Fish and Fish Products. The company’s activities are regulated by the Regulations relating to the Regulation of Exports of Fish and Fish Products.

Norid AS

About the company

Norid is the registry entity for the Norwegian country code top-level domains .no (Norway), .sj (Svalbard and Jan Mayen) and .bv (Bouvetøya). The company assigns, administers and registers these top-level domains in accordance with the agreement with the international manager of top-level domains. Only the .no domain is open for registrations. Norid manages the registration service and domain name service for the top-level domains. The company was founded in 2003. Norid’s head office is in Trondheim.

At year-end 2021, the company had 21 employees and book equity of NOK 79 million. Operating revenues in 2021 were NOK 50 million.

State ownership

The State’s rationale for ownership in Norid is to have control over vital, national internet infrastructure. The State owns 100 per cent of the shares in Norid.

The State’s goal as owner is the provision of secure and accessible registration and domain name services for internet users.

Special framework conditions for the company

The company is financed by subscription fees. The allocation of domain names takes place in accordance with private law and does not involve the exercise of state authority. Norid determines the rules for allocating domain names within the framework of the Norwegian Domain Regulations. The Domain Regulations place an emphasis on cost-effectiveness, a high level of technical quality, non-discrimination, predictability, transparency and user and national interests.

Norsk Helsenett SF

About the company

Norsk Helsenett is responsible for operating and developing secure, robust and expedient national ICT infrastructure that meets the need for efficient interaction between all of the stakeholders in the health and care sector (the Health Network). This includes the development and operation of a number of national services such as helsenorge, the Core Record System, and Electronic Data Interchange (EDI). The customer group consists of all the health trusts, municipalities, general practitioners and other providers in the health and care sector, along with a number of third-party suppliers who provide services to them via the Health Network. The company was founded in 2009. Norsk Helsenett’s head office is in Trondheim.

At year-end 2021, the company had 845 employees and book equity of NOK 451 million. Operating revenues in 2021 were NOK 2.2 billion.

State ownership

The State’s rationale for ownership in Norsk Helsenett is to have direct control of the enterprise that makes necessary digital infrastructure available to the health and care sector. The State owns 100 per cent of Norsk Helsenett.

The State’s goal as owner is to facilitate an expedient and secure digital infrastructure for efficient interaction between all parts of the health and care services, and to contribute to the simplification, rationalisation and quality assurance of electronic services for the benefit of patients and society at large.

Special framework conditions for the company

The company has a tripartite funding model comprising grants from the Ministry of Health and Care Services to perform national tasks, membership fees for access to and use of the Health Network, and the sale of other services. The framework conditions for the tasks the company is to perform are stipulated in an annual letter of assignment from the Ministry of Health and Care Services. This includes framework conditions for the performance of tasks relating to the operation and development of national services and information security.

Norsk rikskringkasting AS

About the company

Norsk rikskringkasting (NRK) provides a broad range of media services through three TV channels, 13 DAB radio channels, the streaming services NRK TV, NRK Super and NRK Radio, the websites www.nrk.no and www.yr.no, and mobile phone content. The company has a presence at 50 locations and has ten regional offices that provide news from across Norway to the entire country. NRK also has ten foreign correspondents. The company was founded in 1933. NRK’s head office is located in Oslo.

At year-end 2021, the company had 3,214 employees and book equity of NOK 1.8 billion. Operating revenues in 2021 were NOK 6 billion.

State ownership

The State’s rationale for ownership in NRK is to have a non-commercial public broadcaster in Norway. The State owns 100 per cent of the shares in NRK.

The State’s goal as owner is to provide high-quality, non-commercial public broadcasting services that meet society’s social, democratic and cultural needs.

Special framework conditions for the company

NRK’s public service remit is set out in NRK’s societal mission (NRK-plakaten) and the company’s articles of association. According to its public broadcasting remit, NRK shall, among other things, support and strengthen democracy, strengthen the Norwegian language, identity and culture, and be universally available. The company’s activities are also governed by general rules set out in Act No. 127 of 4 December 1992 (Broadcasting Act) and associated regulations. The Norwegian Media Authority supervises how NRK fulfils its obligations as a public broadcaster.

Norsk Tipping AS (special-legislation company)

About the company

Pursuant to the Norwegian Gaming Act, Norsk Tipping has exclusive rights to offer a range of gambling activities in Norway. In accordance with the rules laid down by the Ministry of Culture and Equality, the company shall offer gambling in a socially acceptable form under public control, with a view to prevent the negative consequences of gambling. At the same time, through efficient operations, the company shall ensure that as much of the gambling proceeds as possible goes towards socially beneficial causes. The company was founded in 1946. Norsk Tipping’s head office is in Hamar.

At year-end 2021, the company had 404 employees and book equity of NOK 485 million. Operating revenues in 2021 were NOK 43.7 billion.

State ownership

The State’s rationale for ownership in Norsk Tipping is to facilitate a responsible gambling service, prevent the negative consequences of gambling, and ensure that as much as possible of the revenues from the company’s gambling operations go towards to the purposes referred in the Norwegian Gambling Act. The State owns 100 per cent of Norsk Tipping.

The State’s goal as owner is to channel the desire of Norwegians to gamble into moderate and responsible services.

Special framework conditions for the company

The company is regulated by Act No. 103 of 28 August 1992 relating to Gaming etc., and associated regulations, guidelines and gambling rules. The new Gambling Act, which will regulate Norsk Tipping’s activities, will enter into force on 1 January 2023. The Norwegian Gaming and Foundation Authority monitors Norsk Tipping’s performance of its assignment. Pursuant to its articles of association, the company may be instructed by the Ministry of Culture and Equality by letter.

Norske tog AS

About the company

Norske tog procures, owns and manages rolling stock. The company enters into agreements with rail operators that have a traffic agreement with the Norwegian Railway Directorate for the lease of rolling stock. The company was demerged from Vygruppen AS in 2017. Norske tog is headquartered in Oslo.

At year-end 2021, the company had 51 employees and book equity of NOK 3.3 billion. Operating revenues in 2021 were NOK 1.2 billion.

State ownership

The State’s rationale for ownership in Norske tog is to have a provider of rolling stock on competition-neutral terms. The State owns 100 per cent of the shares in Norske tog.

The State’s goal as owner is cost-effective procurement and leasing of rolling stock.

Special framework conditions for the company

Norske tog’s activities are part of the State’s overall sectoral policy in the railway sector. In its role as sector authority, the Ministry of Transport sets the framework conditions for Norske tog’s activities through the national budget and the National Transport Plan. As a sector authority, the Ministry of Transport also sets the framework conditions for Norske tog’s activities through agency management of the Norwegian Railway Directorate as coordinating operator for the rail sector and administration of sector-specific statutes and regulations.

The Norwegian Railway Directorate’s rolling stock strategy and assessment of applications for the residual value guarantee from Norske tog ensure that the quality and size of Norske tog’s supply of rolling stock is adapted as much as possible to the public passenger train service, which is subject to State purchases. The Norwegian Railway Directorate requires passenger train companies that have a traffic agreement with the State to enter into rolling stock leasing agreements with Norske tog. Norske tog’s revenues in these areas are therefore covered by State appropriations for publicly purchased passenger rail transport.

Nye Veier AS

About the company

Nye Veier plans, constructs, operates and maintains sections of national roads, and is planning and constructing a section of railway (Ringerike Line). The company’s development portfolio comprises 1,269 kilometres of main roads and 40 kilometres of double track railway, with an estimated development cost of NOK 270 billion (measured in 2022 NOK). High socio-economic profitability is prioritised in road development. The company has been in ordinary operation since 2016. Nye Veier’s head office is located in Kristiansand.

At year-end 2021, the company had 189 employees and book equity of NOK 2 billion. Operating revenues in 2021 were NOK 6.8 billion.

State ownership

The State’s rationale for ownership in Nye Veier is to safeguard national road and rail infrastructure and contribute to quicker, more efficient and more comprehensive development of parts of the national road and rail network than can be achieved with a traditional approach. The State owns 100 per cent of the shares in Nye Veier.

The State’s goal as owner is the highest possible socio-economic profitability in the road and rail projects for which the company has been assigned responsibility.

In light of the Government having proposed in Proposition 1 S (2022–2023) to return Ringerike Line to Bane NOR and suspend further planning of the joint Ringerike Line and E16 Skaret–Høgkastet–Hønefoss project, the Government intends to adjust the State’s rationale for ownership and the State’s goal as an owner in Nye Veier, such that the company’s area of activity is specified to include road infrastructure and road projects.

Special framework conditions for the company