Summary

Preface

Developments in defence policy, security policy and technology make it increasingly important to view Norway’s security interests in the context of all resources, input factors and expertise that affect operational capability. To manage its own security Norway must therefore maintain a technologically relevant defence industry. The Government will strengthen the ability of the Norwegian Armed Forces to draw on domestic industrial expertise and innovation in order to meet the defence challenges of the future and spur national advances in technology. That is the overall message of a white paper the Government submitted to the Storting on 12 March 2021, presented here in abridged form.

The new strategy emphasises the strategic importance to Norway and its security of the defence industry’s ability to provide the Armed Forces with military materiel, equipment and services. The strategy also documents the competitiveness of Norwegian Defence industry and how it excels internationally in a host of technology areas. The Norwegian Armed Forces must take greater advantage of this national expertise, which the Government will work to maintain and expand. Moreover, defence industrial capabilities and expertise vital to our security interests must remain under Norwegian control.

A key premise of the success for the defence industrial strategy is that all acquisitions contribute to national security and that they are assured full lifecycle support. These considerations will guide the overall effort and our strategic cooperation with the defence industry, which increasingly is where the relevant technologies are developed. We must therefore expand cooperation with leading companies whose technologies can meet the needs of the Armed Forces and strengthen Norwegian security. A major focus is improving cooperation with small and medium-sized companies in Norway. The white paper advocates stronger collaboration between the Armed Forces, academia and business interests in regional innovation clusters. This will lay the groundwork for additional value creation while addressing the needs of the Armed Forces.

Finally, the strategy aims to strengthen international materiel and industrial cooperation, thereby improving the Norwegian Armed Forces’ access to key capabilities and Norwegian industry’s access to international markets. In the coming years, cooperation with Germany on strategic assets such as submarines and missiles will be a key focus area, and Norwegian membership in the European Defence Fund will enhance Norway’s standing in the European military, technology and industrial cooperation. This will support the Norwegian ambition of increased access to foreign markets, which is crucial to maintain an internationally competitive defence industry.

This strategy paves the way for a type of cooperation that will ensure the viability of Norway’s defence industry and enable the Armed Forces to capitalise on that industry’s expertise and innovation. In other words – Cooperation for Security.

Introduction

Norway’s defence industry contributes significantly to the country’s readiness, security and defence capability. Norwegian companies supply about 30 per cent of the materiel procured by the Norwegian Armed Forces. The Norwegian defence industry bolsters our security of supply and expertise in vital areas of technology where its companies are global leaders. A skilled, innovative Norwegian defence industry that is adaptable and competitive in national and international markets is a strategic resource for the country. The Government’s defence industrial strategy therefore views Norwegian companies as an integral part of Norwegian defence and security policy.

Norway’s security policy environment is characterised by rapid changes and growing unpredictability and complexity. Such a turbulent situation poses continual challenges to national security.

The current pace of technological change makes it challenging for most countries to develop expertise in all areas. The importance of cooperating with close allies whose knowledge production complements our own is therefore heightened. The Government will boost development and procurement cooperation with the United States and selected European countries, as well as within the NATO framework and through the European Union.

Most materiel acquired by the Norwegian Armed Forces is fully developed, and most is obtained from international defence contractors. But the Norwegian defence industry also provides advanced technology, specialised expertise and services that significantly strengthen the Armed Forces’ ability to perform current missions and meet new challenges.

This defence industrial strategy aims to maintain and strengthen the international competitiveness of Norway’s defence industry. The objective is to secure the country’s ability to fully or partially develop, manufacture and support defence equipment, systems and services within technology and product areas of special importance to Norwegian national security and the needs of the Armed Forces. Illustrative examples are enhanced military readiness, security of supply and the protection of sensitive information and technology. So is anything that addresses topographic, climatic and other conditions specific to Norway or that strengthens the country’s ability to operate with allies, including our ability to take advantage of their technologies.

Being able to maintain national control over critical functions such as communication, surveillance and certain military capabilities is of great importance to the Armed Forces. Within certain critical areas Norway should also be able to independently maintain and support such systems in times of peace, crisis and armed conflict.

The ability to carry out effective military operations in Norwegian and adjacent areas presupposes that weapon systems and sensors will work effectively in challenging climatic conditions. It is unreasonable to expect the international market being able to satisfy all of Norway’s specific needs, some of which arise from unique climatic and topographic conditions. The imperative security of supply is another reason to maintain national expertise. On a number of occasions Norway has therefore chosen to develop and adapt its own materiel.

Norway’s national defence is based on three pillars: the combined capabilities of its Armed Forces, collective defence through NATO, and bilateral reinforcement plans with close allies. These three elements need underpinning by a modern «total defence» approach that is poised and ready. Norway’s defence industry, alongside with other Norwegian industries, is an important part of this whole.

Culture of Cooperation

Norway actively contributes to NATO solidarity and burden-sharing by harmonising its national long-term plans and investment decisions with the alliance’s capability needs and by contributing forces to NATO operations as well as allied forces and readiness plans. Burden-sharing extends also to the acquisition of relevant materiel, services and expertise. Not least can Norway´s role and recognition in NATO be attributed to defence export within areas where Norway has unique competence and is considered world leading.

Norway’s prominent role in certain defence technology areas is attributable to a complex set of factors, but some of these warrant special mentioning. There is no doubt that Norway’s stable, long-term approach to research activities and product development has been a key factor to the success achieved. Especially noteworthy in this regard is Norway’s three party model of collaboration between the Armed Forces (i.e., military users), defence industry and the Norwegian Defence Research Establishment.

This model promotes a shared understanding of problems and a common approach to resolving operational needs. It has also resulted in a host of world-class products. The three party model contributes to predictable, long-term approaches and relies in part on early dialogue at strategic level. Norway’s Armed Forces consequently become more aware of what the defence contractors and research institutions have to offer in terms of expertise, technology and products. Norwegian industry, for its part, gains both insight in and understanding of what the Armed Forces need.

Textbox 1.1

This defence industrial strategy seeks to enhance operational capability, readiness and supply security by strengthening the Norwegian defence industry’s expertise and competitiveness.

The Armed Forces’ operational needs are the driving force for technology and materiel development, and the three party collaborative model helps create a purposeful division of roles among the various competence areas and organisations involved. The most important success criteria for the model are:

applied research and development that quickly translates R&D results into concrete solutions;

trust-based cooperation and clear delineation of roles enabled by long-term cooperation and established trust among the parties;

long-term priorities and financing as prerequisites for successful development of advanced defence technology;

synergies between national and international markets, with consideration given to allied operations and export potential;

close collaboration between users, researchers and industry, which gives developers a unique understanding of operational needs and challenges;

short communication lines that facilitate good decision-making processes, which make collaboration more effective and relevant.

Going forward, the strengths of this well-functioning model will be sustained, but it should also be further strengthened through more focus on innovation:

Increase utilisation of available commercial technology and expertise.

Exploit the potential of small and medium-sized industrial enterprises and entrepreneurial communities.

Develop and exploit arenas and networks where users, researchers and industry can test and experiment with existing and new technologies.

Increase the scope of concept development and experimentation projects.

Further develop flexible funding mechanisms to make it easier for smaller companies to serve the Armed Forces.

Refine the use of R&D contracts with national industry to promote early-phase collaboration in priority areas of technological expertise.

Norwegian Defence Industry

Although imports cover the majority of Norwegian materiel requirements, domestic defence industrial capacity is crucial to ensure that the Armed Forces always have access to the technology and expertise that they need. Increasingly, components and technologies that are incorporated in military systems and services are identical to those developed for civilian applications. It is therefore important that the Armed Forces and defence industry actively assess and exploit civilian-developed technologies to strengthen defence capabilities.

Textbox 1.2

Clear standards of accountability, integrity and sustainability are required when the Armed Forces cooperate with defence suppliers and carries out acquisitions. Compliance expectations for all parties are heightened due to the large amounts of money and classified information involved.

Over the last 60 years, Norwegian defence industry has evolved continuously to meet the Armed Forces’ needs for materiel, systems, services and expertise. However, Norway’s domestic market is limited. The Armed Forces´ acquisitions of major military platforms are not large and frequent enough for Norwegian suppliers to rely on domestic demand alone to generate sufficient volume and continuity. This has forced Norwegian companies to pursue exports, based on the strength of solutions initially developed to meet domestic needs. Usually, the Norwegian Armed Forces serve as reference customers in export sales, but innovative Norwegian solutions have also been procured directly by allied forces. As a result, Norwegian defence industry has succeeded in the international market, and sales have trended upwards since the early 2000s. The Norwegian defence industry now derives more than 75 per cent of its revenues from international customers.

Figure 1.1 The Naval Strike Missile augments the operational capability of numerous international navy vessels, including the US littoral combat ships.

Photo credit: Shannon Renfroe/US Navy

Norway’s defence industry does not develop large military platforms, but is highly specialised in key national technology areas. Specialisation is a competitive advantage because it enables defence companies to offer systems and components that complement foreign weapons systems. In principle, Norwegian industry can therefore collaborate with all relevant international suppliers of large weapons platforms without competition issues getting in the way.

Norway’s national defence technology and industrial base is primarily centred around Kongsberg Defence and Aerospace and Nammo. They are both considered world-class suppliers of advanced defence materiel, equipment and weapons systems. They are also often referred to as locomotives that attract a great many partners and subcontractors of all sizes and from all around country. Additionally, there are a small number of highly specialised small and medium-sized companies with their own high-tech products.

These small and medium-sized defence companies make up an important part of Norwegian defence industry. They account for almost 2,000 defence-related jobs and some 30 per cent of defence industry sales. All totalled, Norwegian defence industry employs about 7,000 people, including about 5,000 in Norway.

Textbox 1.3

The defence industry in Norway can point to a long list of high-technology products that are competitive in international markets. This would not have been possible without close collaboration between user groups in the Armed Forces, the Norwegian defence industry and the Norwegian Defence Research Establishment (known by the Norwegian initials FFI). The Naval Strike Missile (NSM) is deployed on Norwegian frigates and coastal corvettes. This anti-ship missile system has also been acquired by the United States, Poland and Malaysia, and several other countries are in the process of acquiring or evaluating it. Such successes are the result of a long-term commitment to developing missiles initially optimised for Norwegian coastal operations. This commitment dates back to the 1950s and 1960s, when Terne and Penguin missiles were developed to resist a potential seaborne invasion during the Cold War.

Thirty-five years after development began on the NASAMS ground-based air defence system – this too initially designed for Norwegian conditions – the Armed Forces have a modern air defence system that is the NATO reference standard in its category. As of 2021 the system has been selected by 13 countries and has generated almost NOK 25 billion in export revenues so far. The NASAMS concept is expected to remain operational beyond 2050. Missile propulsion development originating in Norway’s NASAMS programme has been a major success for Nammo. With its unique systems, Nammo has gained admittance to the US and European markets as a supplier to international missile manufacturers such as Raytheon, Diehl and MBDA. Nammo also provides the NSM rocket booster.

Priority Technology Competence Areas

Norwegian industry has developed strong expertise within prioritized technology areas that are considered especially important to national security interest and operational needs.

Therefore, it is especially important to maintain and further develop domestic competence within these areas. These technology areas also serve as a prioritisation mechanism that ensures that available resources are allocated to cooperative military-industry efforts in a way that maximises the effect for the Armed Forces.

Textbox 1.4 Priority Technology Competence Areas

Command and control, information, decision support and combat systems

Systems integration

Autonomous systems and artificial intelligence

Missile technology

Underwater technology

Ammunition, propulsion technologies and military explosives

Materials technology developed or refined for military use

Lifecycle support for military systems

These technology areas will govern prioritisation of defence R&D activities, directed procurement from Norwegian suppliers, and industrial cooperation agreements. They will also be considered when determining which responsibilities Norway should assume in international materiel projects, when cooperating with foreign governments and industry.

The priority technology competence areas were identified by assessing the extent to which they:

help the Armed Forces to secure access to technologies which are suited to Norway’s geography, climate, topography, operations and other factors, but which are not necessarily available in the market;

safeguard the national ability to develop technology not available in the international market;

support national readiness and security of supply;

help to protect critical national information;

help to secure expertise in especially sensitive technologies not available in the market;

secure Armed Forces and industry access to knowledge and expertise by contributing certain world-class Norwegian defence technologies;

are able to support allies by providing world-class defence technology in certain technology areas.

Emerging and Disruptive Technologies and Space Technology

Emerging and disruptive technologies include big data, artificial intelligence, autonomous systems, quantum technology, space technology, hypersonic technology, biotechnology and human enhancement, as well as innovative materials and production methods. These areas are expected to receive increased attention from NATO and will influence priority-setting in the years to come. Certain emerging and disruptive technologies are also relevant to a number of Norway’s priority areas of technological expertise. These are technologies seen as especially important to future allied technology dominance. However, it would be unrealistic for small countries to aspire to master all emerging and disruptive technologies. The best way forward may therefore be to acquire such capabilities and technologies through multinational cooperation.

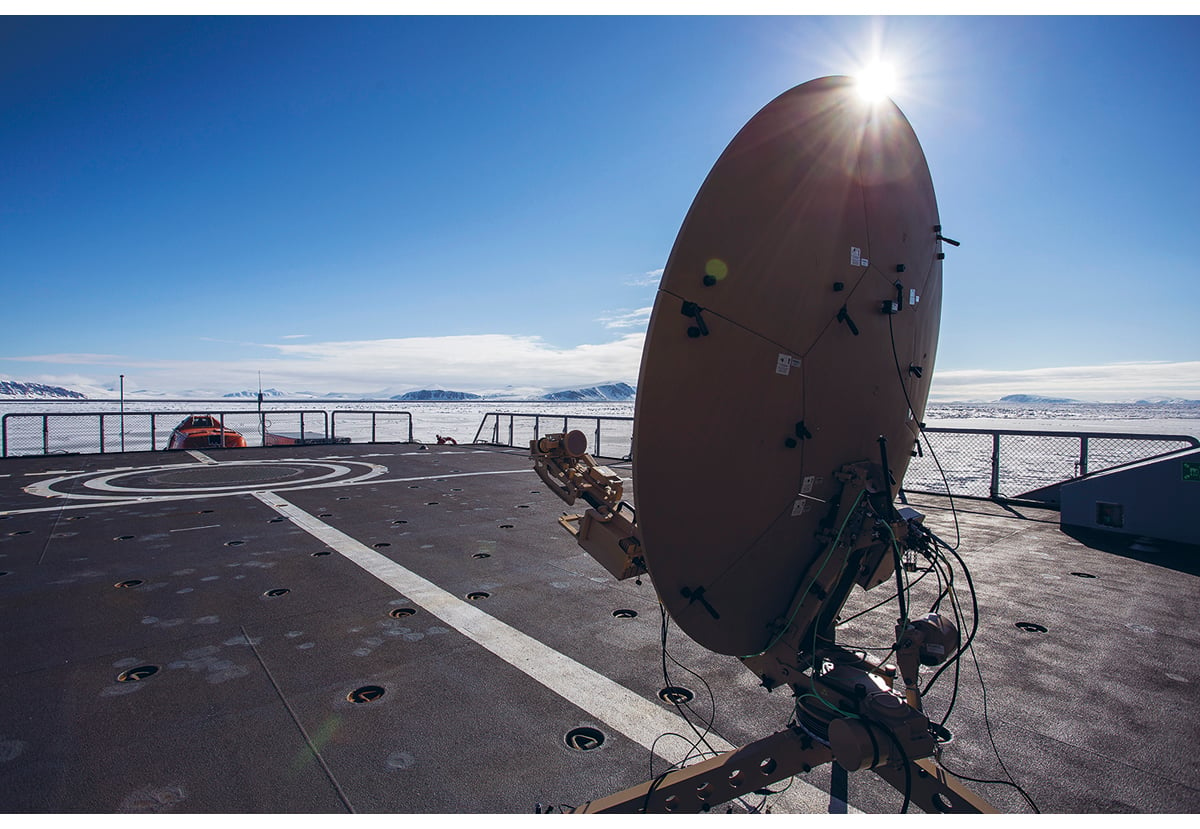

Figure 1.2 The Norwegian Defence Materiel Agency is testing the use of satellites to provide broadband coverage north of Svalbard.

Photo credit: Simen Rudi/Norwegian Defence Material Agency

Space technology and space industry have developed extensively and rapidly in recent years, and space-based capabilities are increasingly being integrated into surveillance, communications and armament systems. Due to its geographic location, Norway requires specially adapted solutions in these areas. Norwegian industry has a long history of developing and manufacturing equipment for satellites and other spacecraft. Furthermore, the Norwegian space industry is a global leader in ground station services and has a large global network of antennas for satellite operations, including downloading and transmission of satellite data. Norway also has advanced testing and production capabilities relevant to both space and defence activities. Norwegian companies are thus well positioned to develop space-related capabilities for defence purposes.

Textbox 1.5

The Government will facilitate acquisition of materiel and services from domestic companies when Norwegian industry is capable of delivering cost-effective solutions that meet the needs of the Armed Forces and are relevant to the goal of maintaining Norwegian development and manufacturing expertise within the eight technology areas.

Defence technology is also incorporated into the core technologies facilitating the shift to a greener economy, such as autonomous shipping, underwater sensor systems for mapping the spread of micro plastics at sea, and low-cost launch systems for satellite for environmental monitoring. The climate crisis and the greening of the economy will have consequences for the Norwegian Armed Forces and industry. Achieving the climate goals of the Paris Agreement will require a major restructuring of society. The Government will pursue a policy that encourages the business community to develop and apply new technologies that are more climate and environmentally friendly.

Armed Forces Acquisitions

As a general rule, all Norwegian defence procurements shall be announced publicly and all bidders should be afforded the opportunity to compete on equal, transparent and non-discriminatory terms. If significant national security interests are invoked, however, it may be necessary to deviate from these procurement principles in whole or in part.

The Government will facilitate the acquisition of materiel and services from national companies when Norwegian industry is equipped to deliver cost-effective solutions that meet the needs of the Armed Forces and are relevant to the goal of maintaining Norwegian development and manufacturing expertise in the eight technology areas.

The fundamental principle in the Armed Forces is to acquire solutions that meet the needs of the Armed Forces and are the most cost-effective in terms of their expected lifecycle. A modest approach and balance between price and performance shall be applied in all acquisitions – an approach that emphasises efficient use of society’s resources while truly strengthening defence capability. To this end, three general principles are applicable.

First, greater attention on the intended effects of the materiel and services required by favouring key requirements over unnecessarily detailed specifications. Acquiring more fully developed products will speed progress towards operative status and lower overall procurement costs. It could also result in lower operating and maintenance costs, especially if the systems chosen are ones that allied countries have already acquired.

Second, in all investment projects, the possibility of acquiring used materiel or available surplus materiel is to be considered when appropriate. And third, attempts are to be made to establish cooperation with allies, partners and civilian stakeholders when doing so is advantageous and in Norwegian interests.

When acquiring certain types of materiel, systems and services, rapid development and continual improvement are essential to the process. Evolving operational needs and requirements for functionality, security and availability must also be considered. A faster, more modern procurement and development methodology is therefore needed, in addition to the traditional procurement methodology. This calls for processes that treat development, security and operation contextually.

Figure 1.3 The MIME program has been initiated to modernize a holistic tactical information infrastructure for the Armed Forces. An additional goal of the program is to make the development process for the ICT solutions, systems and services more efficient.

Photo credit: Norwegian Defence Research establishment

Comprehensive new programmes for acquiring secure information and communication technology (ICT) platforms are to be implemented in long-term strategic partnerships with suppliers so as to enable continual development of the systems and services. The same approach applies for establishing cloud services and combat-oriented ICT services for tactical forces. If such systems are not continually refined, security and operational capability risk being compromised.

In investment planning, one must keep in mind that technological advantages are often short-lived. System solutions should therefore rely on open system architecture and be developed as module-based concepts with standardised interfaces. That way, materiel and systems can be flexibly and cost-effectively upgraded and adapted to changing conditions.

Cooperation between the Armed Forces and the Defence Industry

Due to the pace of technological development, cooperation between the Armed Forces and the defence industry must evolve if new systems and solutions are to reach users in time to make a difference. Interaction with civilian stakeholders and key technology centres must be improved so the Armed Forces can engage more effectively in future technology development efforts.

Development in a number of technology areas is so rapid that steps should be taken to reduce the time spent readying new solutions for service, so the Armed Forces do not end up with obsolete materiel. The Armed Forces must in other words increase its ability to innovate quickly. This strategy seeks to enhance dialogue within the three party collaboration and strengthen relationships between user groups from the Armed Forces, the research institutions and the defence industry. One way of doing that is to promote forums where Armed Forces users over time can collaborate with business stakeholders to explore new opportunities. Making better use of existing arenas where technology developers, service providers and the Armed Forces already collaborate, and possibly creating new ones, would make it easier to present new systems and convey new needs.

Figure 1.4 The Protector weapon station can be remotely operated with high precision from a protected position inside a vehicle, thus protecting operators as well as reducing collateral damage.

Photo credit: KONGSBERG

When researchers, developers and users work together testing and conducting experiments in the lab and in the field, their ability to innovate increases. Early unveiling of prototypes to enable end-user testing and subsequent rapid and continual improvement is thought to result in more productive innovation and development processes. This way of collaborating creates a shared understanding of the technical, safety and conceptual requirements that will determine what is eventually to be acquired, thus reducing risk in the procurement process. An example is an R&D effort carried out to identify prototypes capable of providing secure communications at multiple classification levels. This three party collaboration helped save time and lower procurement risk and enable Norwegian industry to quickly provide a solution. The resulting technology has now been incorporated in the upgrade of the Norwegian Air Force secure communications system. As a result, the operators who monitor military airspace for the Armed Forces are able to work more efficiently.

The results of the Norwegian collaborative model are numerous and convincing, both in terms of operational application and commercial success. Not only has the model helped to resolve specific operational challenges in the Armed Forces. It has also resulted in product development breakthroughs with significant applications in the civilian sector. A prime example of this type of evolution occurred with the remote-control technology in Kongsberg Defence & Aerospace’s Remote Weapons Station. To date, some 20,000 of these stations have been sold to 23 countries, and the technology has been incorporated into a variety of other remote-controlled weapons systems for land, sea and air deployment, including drone defence.

International Cooperation and Market Access

International materiel and industrial cooperation is the key means used by the Armed Forces to acquire the materiel, technology and expertise it needs to perform its tasks. A number of factors affect the cost-effectiveness of such cooperation. The ability and willingness to agree on common specifications for equipment and services, coordinated timelines and procurement processes as well as balanced industrial solutions are among the success factors. Strategic cooperation with close allies and partners can lead to mutual benefits and synergies, and allows the partners to capitalize on their respective comparative advantages.

Exports are fundamental to maintaining a competent and competitive defence industry in Norway. Deliveries to allies and partners make it possible to fund the continued development and upgrading of equipment designed for Norwegian military users. It also reduces lifecycle costs for the Armed Forces.

Success in exporting defence materiel often requires close, long-term cooperation between national authorities and industry. The Norwegian defence industry’s success in the United States shows how effective such a coordinated effort can be. Norwegian participation in the European Defence Fund (EDF) will lay the foundation for increased Norwegian engagement in European defence materiel and technology cooperation and contribute to strengthen the position of the Norwegian defence industry in the European market.

In recent years, a number of countries have expressed increasing interest in government-to-government sales and government-assisted sales of Norwegian defence equipment. In some cases, a formal contract signed by the governments of the buying and selling countries is required for a company to be selected as a supplier. Such bilateral contracts enhance predictability and security for the purchasing country. This type of contracts may also be helpful in facilitating bilateral cooperation such as military and logistical cooperation, controlling the spread of technology and generating mutual benefits from the sale of new materiel.

Industrial cooperation agreements with foreign suppliers to the Armed Forces are an important and powerful tool for breaking down trade barriers in the international defence market and providing entry for Norwegian contractors into the supply chains of large international companies. In the absence of an international defence market characterized by genuine, open competition and equal treatment of bidders, industrial cooperation agreements will remain a crucial defence industrial tool.

Norway has comprehensive, stable and transparent export regulations governing sales of defence equipment to other countries. A rigorous assessment is required of the foreign policy and domestic conditions in potential recipient countries. Norway does not permit the sale of weapons and ammunition to regions where there is a war or threat of war, or where there is civil war. Consideration must also be given to democratic rights and respect for fundamental human rights and humanitarian law in recipient countries.

The Norwegian Security Act is an important instrument for safeguarding core national security interests. A strategy for the protection of Norwegian-developed defence technology has also been established to prevent any technology from becoming compromised to the detriment of Armed Forces´ capabilities. An updated Act relating to inventions of importance to the country’s defence is also under preparation, creating a robust legal basis for protective measures when exporting Norwegian defence materiel.

Strategic Partnership with Industry

Strategic partnerships with industry will help the Armed Forces secure long-term access to materiel, services and expertise, while improving the ability to act in accordance with the principle ˝ as civilian as possible and as military as necessary˝ . With advances in technology and digitalisation, there is a continuous need to devise new ways of working. This dynamic must be turned to advantage in a way that increases defence capability. Technology itself does not create a more effective organisation. Benefits arise when technology, personnel, expertise, organisational structure and management are properly coordinated. Advances in technology and digitalisation make it possible to reap benefits in a wide range of Armed Forces’ activities, including system support, security of supply, development and application of new technologies, purchase of services and materiel acquisitions.

It is crucial that specific agreements emerging from strategic partnerships carefully address matters of operational capability, security, vulnerability, readiness, international legal affairs, personnel and expertise. In a long-term partnership between the Armed Forces and private industry, both risks and benefits are shared.

Figure 1.5 The Armed Forces has entered a strategic agreement with the logistics provider Bring to secure transport services. The agreement entails that Bring employees and materiel will be made available to the Armed Forces in times of crisis or armed conflict. Bring will also participate in the Armed Forces training and exercises.

Photo credit: Bring

Enhanced Cooperation with Small and Medium-Sized Businesses

In order to make use of Norway’s entire technology potential, the Armed Forces should improve its ability to exploit expertise residing in companies and ecosystems beyond the traditional defence industry. One way of doing this would be to develop new schemes with programmes for small and medium-sized enterprises, modelled on those used in other NATO countries, possibly involving tender announcements, competitions, customised contract models and financing solutions, as well as improved arenas or forums that encourage dialogue and cooperation between small and medium-sized enterprises and military user environments.

It is also necessary to establish or develop arenas and processes to strengthen contact between companies and the military users of solutions and materiel. Dialogue with relevant user environments strengthens the potential for positive outcomes. Where appropriate, local and regional cooperation clusters can be established with participation by the Armed Forces, industry and educational and R&D environments.

Conclusion

The overall goal of the Norwegian national defence industrial strategy is to maintain and further develop an internationally competitive Norwegian defence industry that can protect Norway’s essential national security interests.

This strategy creates the framework for furthering the already well-functioning cooperation between the Armed Forces and the defence industry, while adding new initiatives and measures in line with key national goals for the sector. The broad parliamentary support gives the Norwegian Ministry of Defence a clear mandate to continue to uphold national security interests by:

further developing the close collaboration with domestic defence related industry;

protecting legitimate national security interests in connection with procurements from foreign suppliers;

promoting access to international markets, and requiring industrial cooperation when making acquisitions abroad.

The strategy emphasises not only materiel but, increasingly, expertise and services. Cooperation and partnerships are important mechanisms for employing new technology needed by the Armed Forces.