2 The work of the Council on Ethics

The Council on Ethics for the Norwegian Government Pension Fund Global is an independent body that makes recommendations to Norges Bank to either exclude companies from the GPFG or place them under observation. The Council’s assessments are based on ethical guidelines for the GPFGs investments, determined by the Norwegian Ministry of Finance. The guidelines contain both product-based exclusion criteria, targeting the production of tobacco, cannabis, coal or certain types of weapons, and conduct-based exclusion criteria, such as serious financial crime, the sale of weapons to certain states, human rights abuses and environmental damage. The threshold for exclusion is intentionally high. The guidelines are forward-looking and apply to unacceptable conditions that are ongoing or may occur in the future. They are not meant to be a mechanism through which to punish companies for past actions. All the Council’s recommendations are published on its website as soon as Norges Bank has announced its decision.

Portfolio monitoring and information gathering

The Council constantly monitors whether companies in which the GPFG has invested engage in operations that fall within the scope of the Guidelines for Observation and Exclusion from the Government Pension Fund Global. The Council works on many cases and issues in parallel. Several consultants have been commissioned to identify companies whose operations may be covered by the exclusion criteria. In addition, the Council monitors a number of databases and websites containing information on, for example, corruption, weapons sales or companies’ human rights abuses. The Council is also approached by organisations and individuals who call on it to consider specific cases. These contacts may be made directly to the Council or forwarded from Norges Bank.

The Council assesses every company that the portfolio-monitoring process flags up in relation to the product-based criteria. However, cases relating to the conduct-based criteria are highly heterogeneous. The Council therefore selects only certain cases for further investigation on the basis of the violation’s scope and seriousness, its consequences, the company’s responsibility for or contribution to the matter concerned, what the company is doing to prevent or mitigate the harm caused, and the risk of similar incidents occurring in the future.

Access to information varies significantly from country to country. To compensate for the fact that not all serious cases are picked up on through day-to-day portfolio monitoring, the Council undertakes its own inquiries into areas of high risk. When the Council has selected a particular issue for further investigation, it generally follows this up over several years. For example, the Council has focused on companies that dispose of decommissioned vessels for breakup at yards where working conditions and environmental safeguards are extremely poor since 2017, and has kept a keen eye on the extraction of natural resources from Western Sahara since as far back 2005.

The Council obtains information from research environments as well as national and international organisations, and often commissions third-party consultants to investigate specific cases. The Council also communicates with company officials during the assessment process.

Tabell 2.1 The Council on Ethics’ activities in the period 2021–2023

Year | 2021 | 2022 | 2023 |

|---|---|---|---|

No. of limited companies in the GPFG at year-end | 9340 | 9228 | 8859 |

No. of companies excluded at the recommendation of the Council on Ethics at year-end | 80 | 91 | 92 |

No. of companies placed under observation at the recommendation of the Council on Ethics | 9 | 9 | 12 |

No. of companies on which the Council on Ethics issued a recommendation during the year | 21 | 21 | 16 |

No. of companies excluded during the year at the recommendation of the Council on Ethics | 12 | 13 | 6 |

No. of companies placed under observation during the year | 3 | 4 | 5 |

No. of observations concluded during the year | 0 | 4 | 2 |

No. of exclusions revoked during the year | 3 | 2 | 2 |

No. of new cases accepted for assessment during the year | 91 | 81 | 102 |

No. of cases concluded during the year | 86 | 79 | 100 |

Total no. of companies under assessment during the year | 195 | 193 | 209 |

No. of companies the Council has been in contact with | 66 | 71 | 69 |

No. of companies the Council has met with | 12 | 14 | 11 |

No. of Council meetings | 14 | 10 | 10 |

Secretariat (no. of staff) | 8 | 9 | 9 |

Budget (NOK million) | 18 | 20.2 | 18,1 |

The table summarises the scope of the Council’s assessment of companies in 2023, compared with in 2022 and 2021. Companies excluded by Norges Bank under the coal criterion, without the Council’s recommendation, are not included in the table. Companies that have been delisted from a stock exchange are removed from the list of excluded companies as and when delisting occurs. This applied to three companies in 2023.

Summary of the Council’s activities in 2023

Table 2.1 provides an overview of the Council’s activities over the past three years. The companies in which the GPFG has invested form the starting point for the Council’s endeavours. At the close of 2023, the GPFG had invested in just under 9,000 limited companies headquartered in more than 70 countries.

At the close of 2023, 92 companies were excluded from investment by the GPFG at the recommendation of the Council on Ethics. A further 12 companies were under observation. In addition, Norges Bank has, at its own initiative, excluded 72 companies under the coal criterion and placed a further 12 under observation. Since 2022, Norges Bank has also been permitted to assess companies under the climate criterion without needing a recommendation from the Council. So far, however, the Bank has not published any such decisions.

The Council issues recommendations to Norges Bank, which makes a decision on the case in question. In 2023, the Council issued recommendations on 15 companies. Ten recommendations related to exclusion, two to the revocation of exclusion, one to observation and two to the termination of observation.

Since Norges Bank performs a thorough assessment of all the Council’s recommendations, and it also takes time to divest shares in companies, some of the decisions published in 2023 relate to recommendations issued by the Council in 2022. For the same reason, not all the recommendations from 2023 have yet been published. All recommendations are published on the Council’s website at the same time as Norges Bank announces its decision after the securities have been sold.

The Council always has many cases in progress, and it is common to have cases under assessment in relation to the majority of exclusion criteria. It is not unusual for a company to be the subject of several different cases. We also have cases involving more than one company. In 2023, the Council worked on a total of 223 cases, relating to 209 different companies. Of these, 102 were opened during the year, while 52 were opened in 2022. The assessment of 100 cases was concluded during the year. This includes cases on which a recommendation was issued to the Bank, cases where no grounds for exclusion or observation were found, and cases relating to companies in which the GPFG was no longer invested. The Council investigated five companies which left the GPFG without a recommendation being issued.

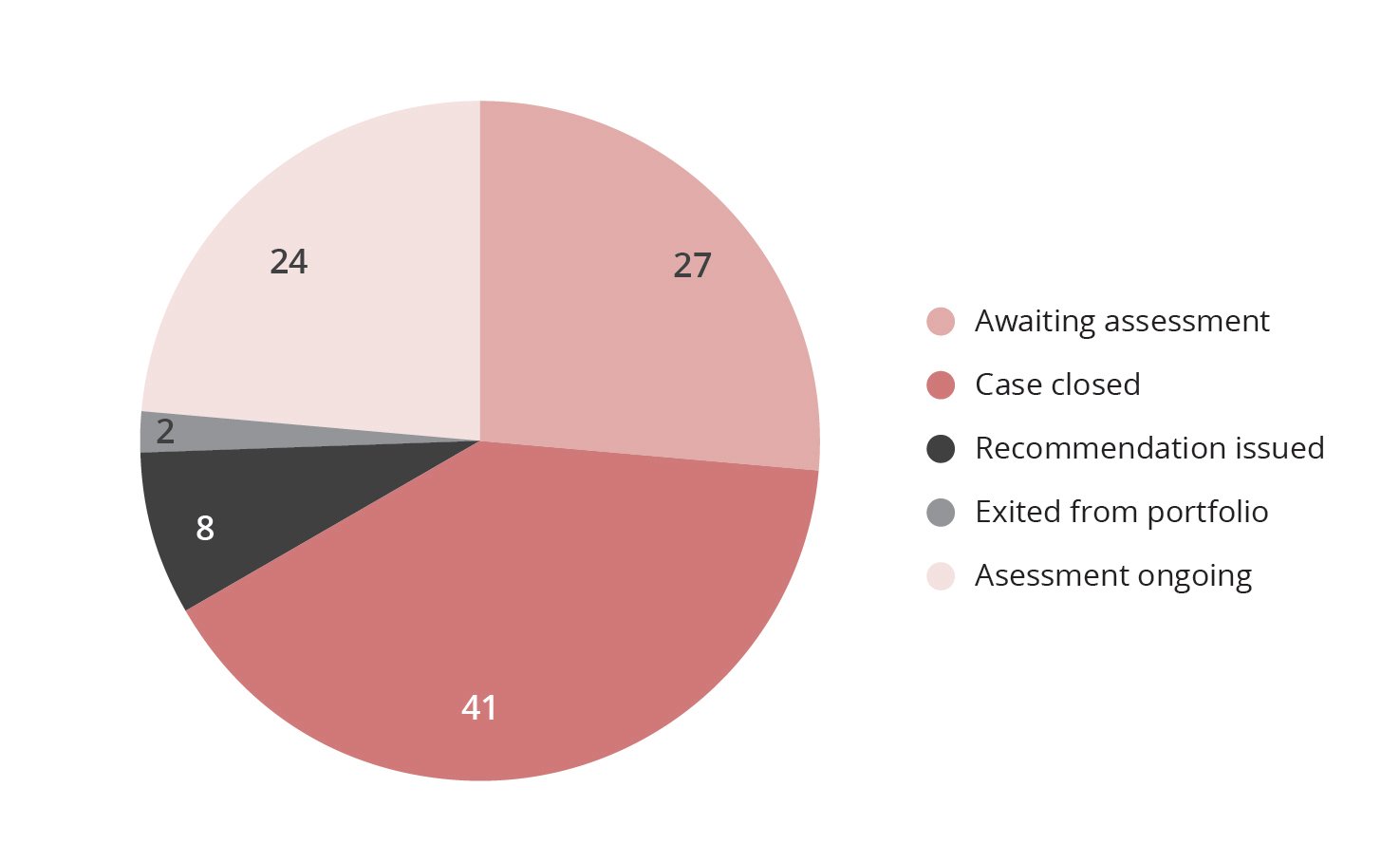

Figur 2.1 Status of new cases opened during the year

Fig. 2.1 shows how the 102 cases opened for assessment in 2023 were dealt which. The majority of cases do not end in a recommendation to exclude a company or place it under observation, but are shelved at an earlier stage in the assessment process. With respect to the 102 new cases in 2023, eight resulted in recommendations to exclude or place a company under observation, or to terminate a company’s exclusion or observation period, while 41 were shelved. The assessment of two new cases was terminated because the companies were no longer in the portfolio, 24 cases are still under assessment, while the assessment of 27 cases has not yet commenced.

The risk of gross corruption in the construction industry was the basis for assessment in 16 of the cases opened in 2023. The vast majority arose from a general review of corruption cases linked to companies in this business sector. Other frequent topics relate to the production and sale of weapons, operations in areas of war or conflict, labour rights violations or loss of biodiversity.

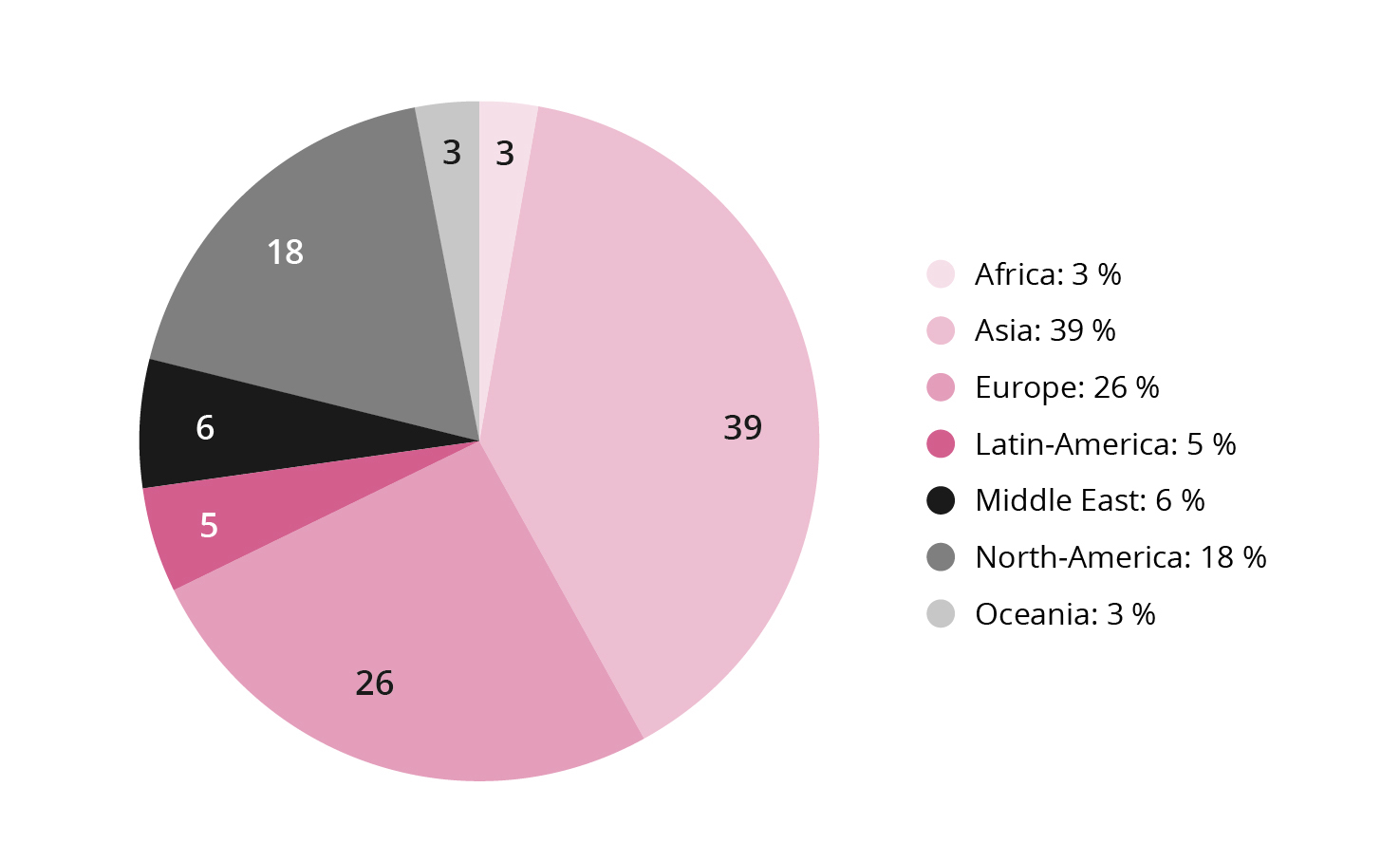

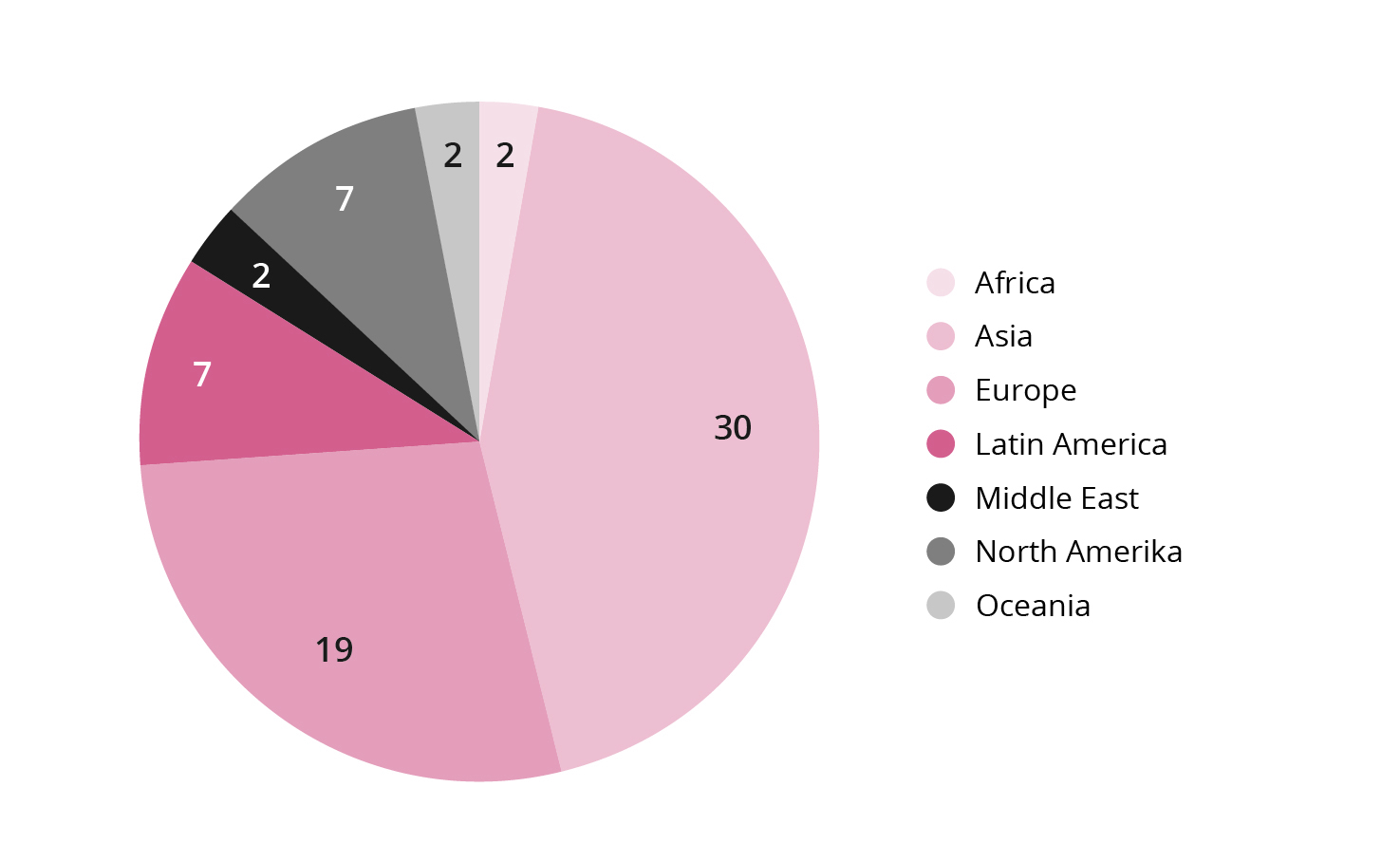

Figur 2.2 Regional breakdown of the GPFG’s 8,859 shareholdings at the close of 2023

Figur 2.3 Regional breakdown of the companies assessed by the Council

Fig. 2.2 shows the regional breakdown of the GPFG’s shareholdings at the close of 2023, while fig. 2.3 shows the regional breakdown of the companies assessed by the Council during the year. The geographic distribution of the companies assessed by the Council varies from year to year. While in previous years the Council on Ethics has had a slight overweight of Asian companies under review, compared with the proportion of Asian companies in the portfolio, in 2023 there was a corresponding overweight of European companies under review. This is partly due to a decline in European companies in the portfolio towards the end of the year, while the proportion of Asian companies has increased.

Around half of the 80 or so Asian companies that the Council assessed in 2023 relate to human rights abuses, primarily poor working conditions and forced labour. Gross corruption and serious environmental damage were otherwise the predominant grounds for assessment. The Asian companies are often examined as part of a review of issues that the Council monitors particularly closely because the ethical risk is high. This applies, for example, to the risk of migrant worker exploitation in multiple countries, human rights abuses in China’s Xinjiang province and the risk that companies operating in Myanmar are contributing to the military junta’s abuses. Some companies are identified through the general portfolio monitoring process. Eleven of the companies on which the Council issued recommendations in 2023 were from Asia.

In 2023, the Council has worked with almost 60 companies from 16 different European countries. In the past couple of years, the majority of cases have related to the risk of corruption and other financial crime, as well as various human rights abuses. The human rights cases involve violation of labour rights, forced migration and violation of the rights of Indigenous peoples. Two of the companies on which the Council issued recommendations in 2023 are European.

Around 50 companies are domiciled in the Americas. The predominant grounds for assessment in these cases are human rights abuses and gross corruption. The other cases are evenly spread across the other criteria for which the Council is responsible. One of the companies on which the Council issued a recommendation in 2023 is from North America.

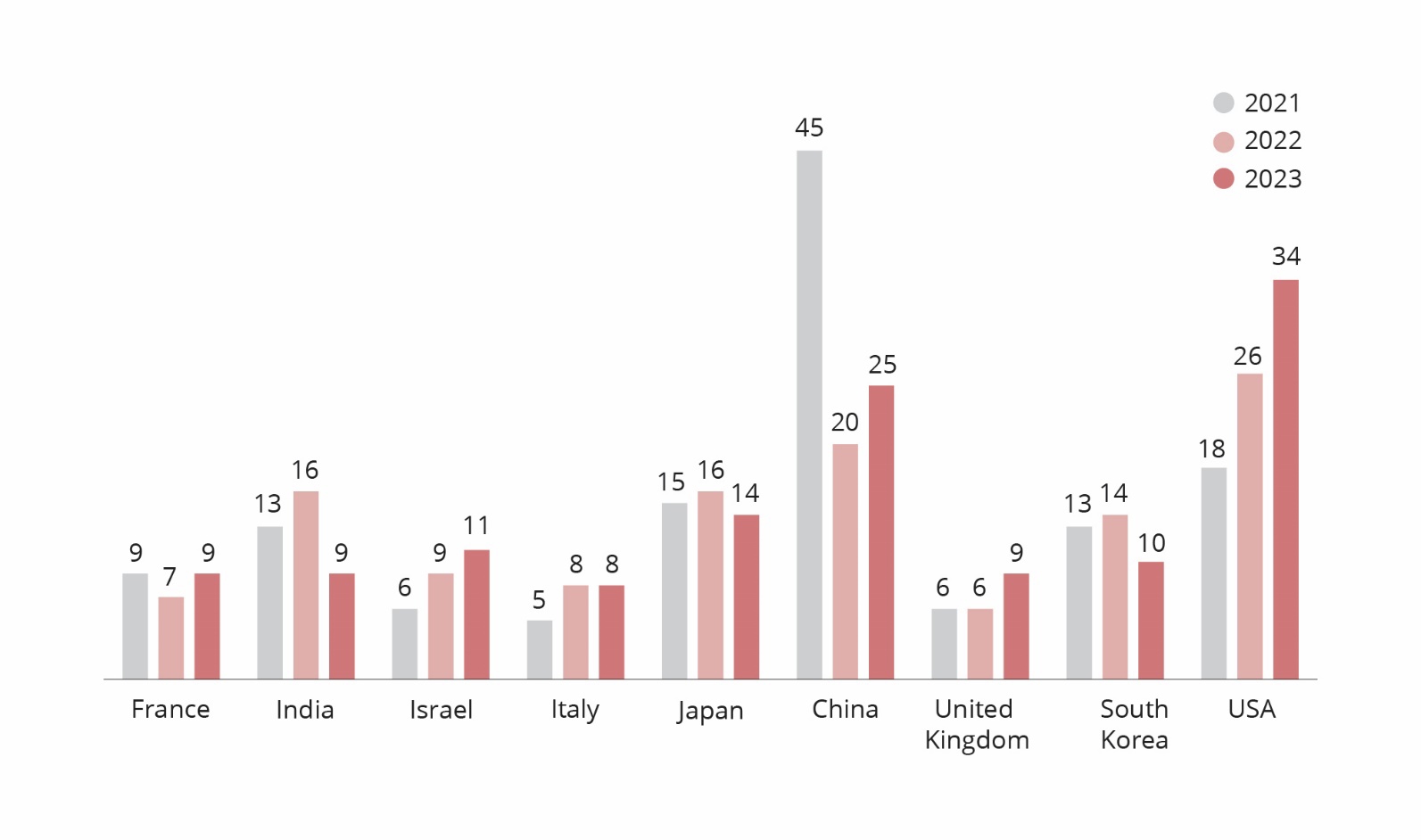

Figur 2.4 Countries with most companies under assessment

Fig. 2.4 shows the number of companies under assessment in 2021, 2022 and 2023 from the nine countries from which most companies under assessment in 2023 were drawn. In 2022, Malaysia was included in a similar presentation.

The number of companies from the USA which are under assessment continued to rise in 2023. These cases relate to a variety of norm violations across the majority of criteria. Most of the companies assessed under the weapons-related criteria are domiciled in the USA. There is now a better correlation than before between the proportion of US companies under assessment and the number of US companies in the GPFG.

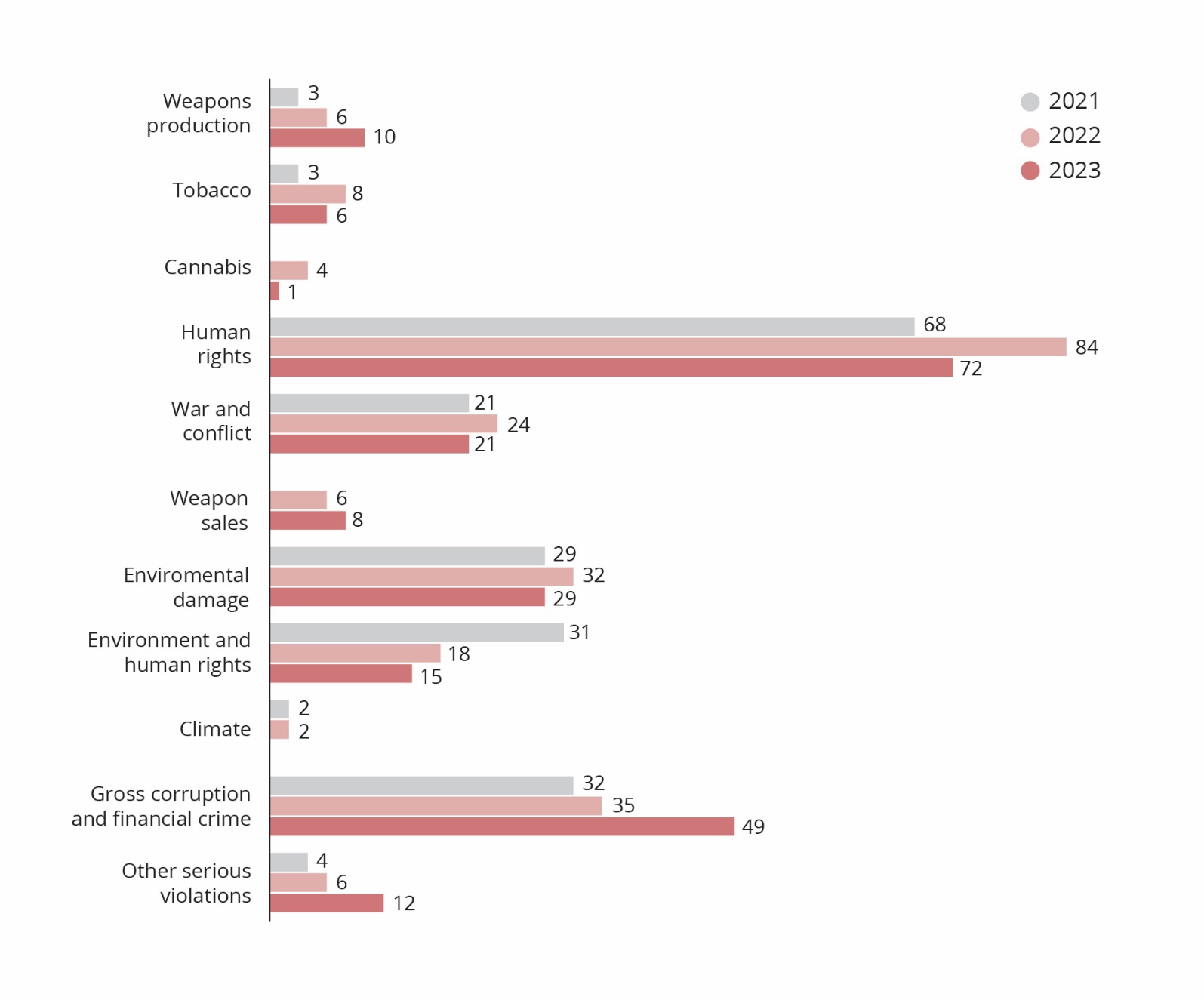

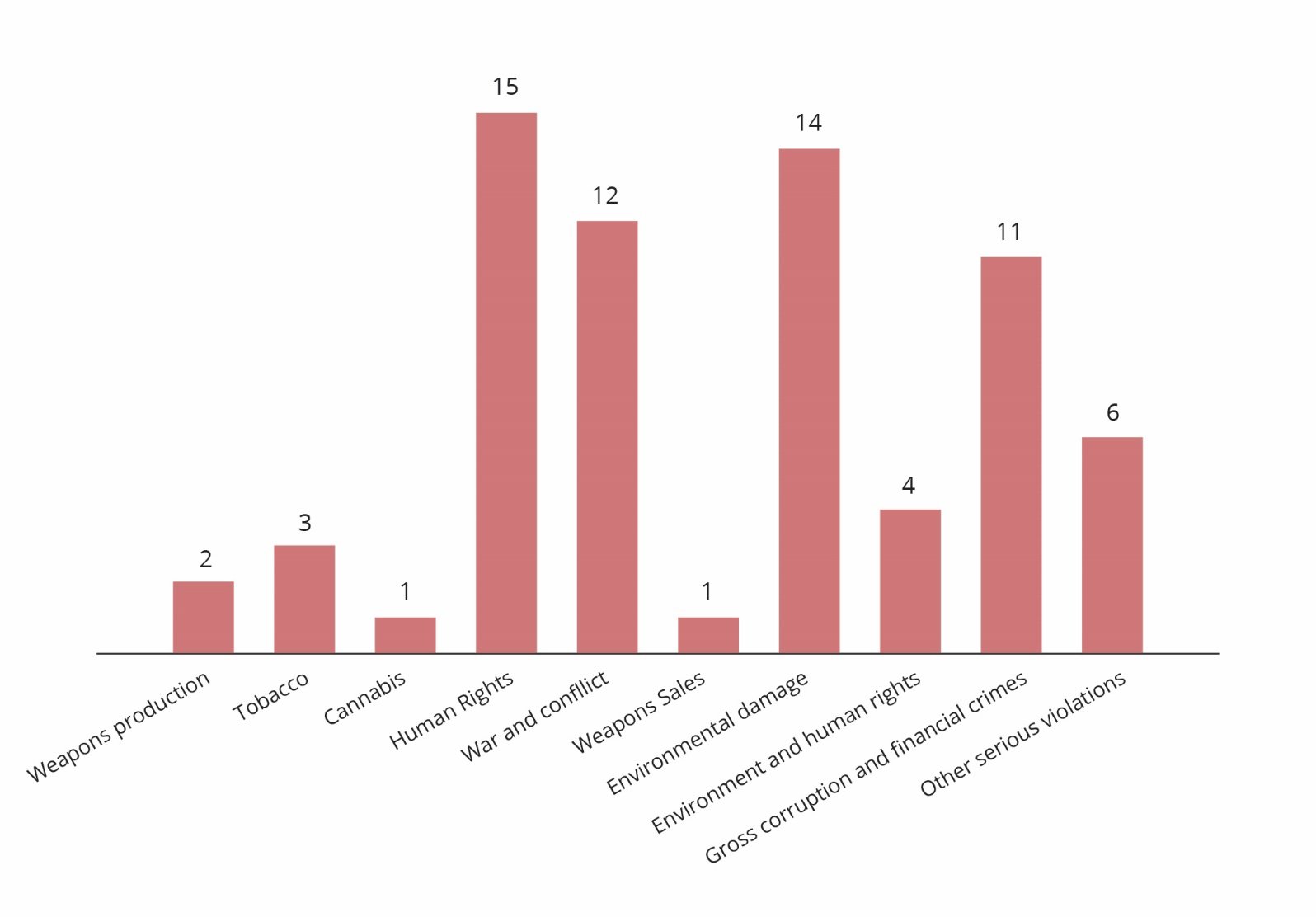

Figur 2.5 Breakdown of the Council’s work by criterion

Work under the various criteria

Fig. 2.6 shows a breakdown of the cases the Council has worked on in 2023, by exclusion criteria. There has been a sharp increase in the number of companies being assessed in relation to financial crimes, while the number of cases under assessment in relation to the criteria “Other serious violations” and “Production of certain types of weapons” has continued to rise. This is partly due to the changes in the guidelines resulting from the Ethics Commission’s report. These included an expansion of the corruption criterion to also encompass other forms of financial crime; serious abuse of animal welfare was clearly designated within the criterion for other serious violations; while the product-based weapons criterion was expanded to also encompass nuclear weapon delivery platforms.

Human rights cases continue to predominate, followed by financial crime. Many of these cases spring from investigations the Council has itself initiated. These may be based on suppositions about the risk of forced labour in some countries or corruption in certain business sectors. The Council initially assesses all companies with operations that may be exposed to this risk. It then selects the companies where the risk appears to be greatest and contacts them to request information that can confirm or disprove the Council’s suppositions. In such assessments, a large number of companies may undergo a preliminary assessment, while the focus is relatively quickly narrowed to just a few.

Around half of the human rights cases relate to labour rights. In addition, the Council continues to focus on the abuse of Indigenous peoples’ rights. Indigenous people are often vulnerable to abuse in connection with the extraction of natural resources and infrastructure building, and there are also cases where companies have established plantations on land claimed by Indigenous people. Furthermore, the Council is still closely monitoring companies that dispose of decommissioned vessels to be broken up for scrap at yards where working conditions and environmental safeguards are poor. Companies investigated in relation to shipbreaking are assessed under both the human rights criterion (extremely poor working conditions) and the environment criterion (pollution).

In 2023, the Council has assessed a number of cases under the war and conflict criterion, where GPFG-invested companies have financial partnerships with companies controlled by the armed forces in Myanmar. Other cases have related to the West Bank and Gaza, as well as companies with operations in Russia.

The loss of biodiversity is the predominant basis for assessment under the environment criterion, followed by industrial pollution. The four companies whose exclusion the Council recommended under the environment criterion in 2023 all related to the loss of biodiversity.

The main focus for the cases assessed under the financial crime criterion was corruption in the construction industry and banks that fail to comply with the legislation intended to prevent and deal with suspicions of money laundering. A survey of corruption cases relating to a large number of companies was carried out in 2023. Many of these were shelved at an early stage in the assessment process.

With regard to the criterion concerning other serious abuses of fundamental ethical norms, the Council has focused particularly on the risk of serious animal welfare abuses. This criterion is applied to all serious norm violations that do not naturally fall within the scope of the other criteria. The types of cases therefore differ widely. In 2023, they ranged from the risk of damage to cultural heritage sites to involvement in Russia’s war of aggression against Ukraine.

Contacts with companies

Figures 2.7 and 2.6 show breakdowns of the Council’s contacts with companies in 2023, by criterion and by region. The Council has been in contact with 69 companies and held meeting with 11 of these. The Council contacts companies which, following a preliminary assessment, it wishes to study in more detail. The Council initially asks the company for information that could provide a better foundation for an assessment of its operations. Every company that is assessed in relation to the conduct-based criteria is given the opportunity to comment on a draft recommendation, before the Council issues its recommendation to Norges Bank.

Figur 2.6 Breakdown of contacts with companies by criterion

Figur 2.7 Breakdown of contacts with companies by region of domicile

The Council attaches importance to information provided by companies and considers that a lack of response from companies may contribute to a heightened ethical risk. Most companies respond, although there are some exceptions. Of the 55 companies the Council contacted in 2023, 19 failed to respond. Some of these were contacted late in the year, so a response may still be forthcoming. In 2023, the Council issued recommendations to exclude two companies that had not replied to the Council’s queries.

In 2023, the Council’s contacts with European companies rose sharply. Two of these companies are under observation, while the exclusion of another has been revoked. The number of Asian companies contacted by the Council has fallen slightly since 2022, but this reflects the regional distribution of companies under assessment.

When the Council meets with companies, it is often late in the assessment process – often in response to a draft recommendation to exclude a company – or in connection with the observation process. Fig. 2.8 shows a breakdown of the companies the Council met with in 2023 and the criteria against which they were being assessed. Two of the companies the Council met with in 2023 are under observation, while one has been excluded for several years.

Figur 2.8 Number of meetings with companies, by criterion

Assessment of companies that are excluded or under observation

Companies are not excluded for a specific period of time and their exclusion may be revoked if the grounds therefor no longer exist. Norges Bank decides whether to revoke a company’s exclusion on the basis of a recommendation from the Council on Ethics.

During the observation period, the Council normally submits one or more observation reports to Norges Bank on each company placed under observation at the Council’s recommendation.

In 2023, the exclusion of two companies was revoked and the observation of two companies terminated.